Federal Budget: small steps in the right direction with significant changes to super now and company tax progressively over the next 10 years

Two major factors necessarily limited Scott Morrison and Malcom Turnbull in their first crack at a Federal Budget – our relatively fragile economy, as evidenced by yesterday’s RBA announcement, and the fact that an election will be called within days. The bottom line is that these factors prevented this year’s Budget from being more adventurous in terms of addressing spending in particular, but overall the package of measures announced last night seems a million miles away from the approach adopted in 2014, (modestly) nudges our overall fiscal health in the right direction whilst providing some significant new challenges for self-fund retirees and those aspiring to build wealth via their superannuation.

The bottom line

The underlying cash deficit for the current year is expected to be $40 billion, reducing to $6 billion in 2019/20 – to the extent that forward estimates can be relied upon. Government receipts will rise from 23.5% of GDP this year to 25.1% in 2019/20. Baked in spending programs see total Government outlays rise to 25.6% of GDP over the forward estimates.

As last night’s Budget did not contain any significant new spending measures, or major reductions to existing spending, the major changes to the forward estimates are based on a combination of taxation changes and the underlying economic growth assumptions. We’ll turn our attention to the taxation and superannuation changes shortly, while noting here that this year’s economic growth assumptions have been downgraded (from those previously published in MYEFO). This is partly a reflection of a more genuinely subdued level of optimism from the Government regarding the underlying health of our economy. It’s also a reflection of the political reality that to adopt different numbers would have been hard to justify in the face of the upcoming Pre-Election Economic and Fiscal Outlook, which has to be published within 10-days of an election being called. If the Budget assumptions differed greatly from these soon to be released numbers, Mr Morrison and Mr Turnbull would have a very hard time justifying those differences given their proximity in time.

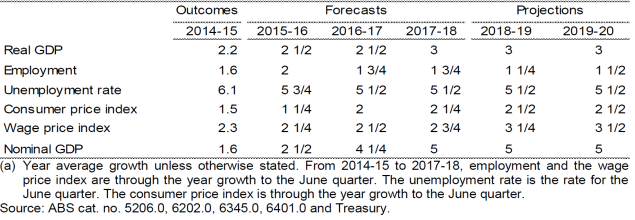

While one could quibble with the detail of these forecasts, they appear reasonable. Relative to the MYEFO, real GDP growth has been cut by 0.25% in 2016-17 before returning to 3%. The unemployment rate is forecast to hit 5.5% by June (it is currently 5.7%); previously it was expected to take a year or two to get to that level. Growth in nominal GDP, which depends heavily on the terms-of-trade, has been revised down from 4.5% to 4.25% in 2016-17. The CPI forecast acknowledges the extraordinarily low March quarter result and suggests it may take 3 years to get back to the centre of the RBA’s target range.

The Budget uses an iron ore price of US$55 a tonne, up significantly from the US$39 assumed in the MYEFO. Significantly, the price has risen in recent weeks, although it is not clear yet that this will stick. If the price were to average, say, $65 a tonne, the (positive) effect on receipts would be $1.4 billion this year and $32.9 billion in 2017/18.

The measures

Three major areas were targeted by Mr Morrison last night.

Firstly, superannuation where larger balances and high income earners have been singled out for attention with the introduction of a $500,000 lifetime non-concessional super contribution limit, the reduction in the income threshold for the additional 15% tax on super contributions of income earners above $250,000 per annum and the introduction of $1.6 million lifetime transfer balance cap. Most importantly for self-funded superannuants with pension phase balances in excess of $1.6 million today, there is no grandfathering of the balance transfer cap and excess balances will need to be rolled back into accumulation accounts by 30 June 2017 assuming this measure is passed. A reduction in the annual limits to concessional contribution caps to a flat rate of $25,000 for all members has also been proposed and will require additional mid-career planning by individuals who will be less able to make additional contributions as they approach retirement. On the other side of the ledger, the Government has proposed the removal of the work test for those aged 65-74 enabling additional later-in-life contributions to be made and has introduced some additional catch-up and low-income provisions for members with balances less than $500,000 and/or annual incomes below $37,000.

Secondly, business taxation was in the spotlight with a reasonably bold move towards a flat 25% company tax rate being introduced over the next decade. This move starts with a broadening of the small business definition to include businesses with a turnover of up to $10 million in 2016-17 and up to $25 million in 2017-18. July 2016 will also see the small business entity turnover threshold increase from $2 million to $10 million for a range of small business tax concessions such as simplified depreciation rules, optional cash accounting of GST and FBT exemptions. Internationally our company tax rates are high, and these changes should be seen as being positive for employment and for growth as well as being good news for our ongoing aspirations to win new foreign investment. Politically the reduction in company tax rates will be easy to criticise, but this criticism is short-sighted and misses the major point about company tax rates being highly inefficient and a real limiter to growth and investment. On the revenue raising side, and in response to growing public awareness of aggressive corporate tax minimisation of multi-national corporations, the Government is aiming to introduce a Diverted Profits Tax (often referred to as a ‘Google Tax’). Additional funding to the ATO and ASIC also reflects a strengthening enforcement approach.

Thirdly, personal taxation where limiting the bracket creep for middle income earners with the increase of the bottom of the 32% tax-rate bracket from $80,000 to $87,000 and removal of the temporary budget repair levy for those earning more than $180,000 from 30 June 2017 are the major points. Whilst the weekly hip-pocket impact of these personal tax changes are modest, they do reflect sensible changes towards a more balanced personal income tax table, although they are also open to political attack as, by definition, they only apply to income earners on more than $80,000 per annum. No doubt we will hear plenty about that in the coming debate.

More to do

From a macro-perspective, this Budget leaves plenty of heavy-lifting for next year and the year after. Additionally there was no mention of a strategy or long-term vision to transition the economy to a more renewable energy future but the economic and political reality of today mean the measures introduced probably strike a reasonable balance in terms of equity, prudence and getting-on-with-the-job of restoring budget sustainability in the short-term whilst imposing new hurdles to those with or accumulating significant super balances. Of course, it will be up to the electorate to decide how they feel about these matters over the coming weeks. Whoever wins the upcoming Federal Election, you can be sure that superannuation and taxation changes will continue to be introduced as we ever so slowly start to work our way back to a more sustainable budget position.

This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice. MGD Wealth Ltd is the holder of Australian Financial Services Licence No. 222600.