To keep up to date with more articles like this, subscribe to Andrew’s newsletter.

Life expectancies are increasing. Last month, the Australian Bureau of Statistics reported that current female life expectancy has increased to 84.6 and male life expectancy sits at 80.4. The Australian Government’s 2015 Intergenerational Report predicts that by 2055 the average female life expectancy will be 96.6 and the average male life expectancy will be 95.1. That means, by 2055, a person retiring at age 65 may have roughly 30 years ahead of them in retirement.

While life expectancies are on the rise, interest rates are sitting at historic lows, and look like they’ll stay there for some time yet. Many retirees rely on investment income to fund their retirement years. However, the current low return environment means retirement savings have to stretch further than ever before and the income provided by today’s low yields may not be enough.

Retirement planning is often neglected during peak spending years. Understandably, the focus is instead placed on other areas such as studies, travel, paying down the mortgage or children’s education. While the thought of leaving working life behind can be daunting, most people don’t feel the need to think about it, at least not until they’re nearing retirement, and are therefore unprepared for a retirement that could last almost as long as their career.

However, the earlier a person starts to plan and implement personal, lifestyle and financial strategies, the more prepared they will be in ensuring their retirement years are both emotionally fulfilling and financially rewarding.

Making sure you have enough

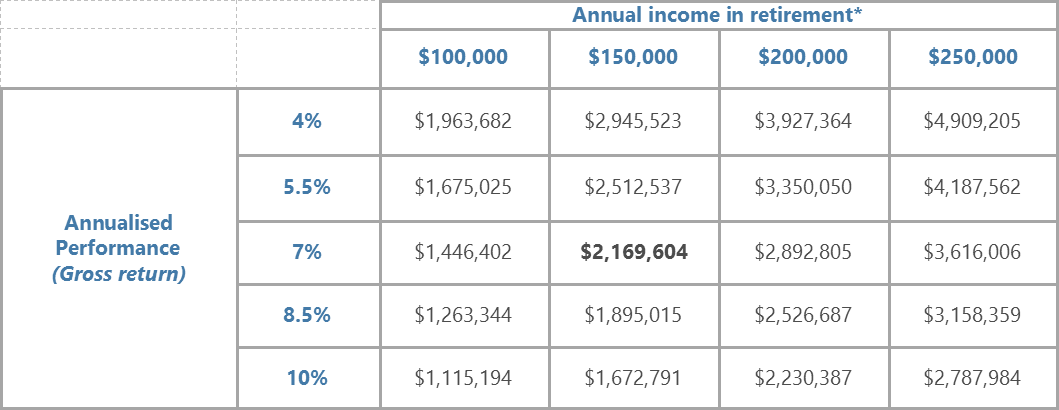

Mapping out a smart investment and retirement strategy can help ensure you have enough capital for your golden years. However, before you do this, you need to determine how much you will need. This varies from person to person and depends on a number of factors from the desired lifestyle to spending habits to estimated life expectancy as well as important considerations including sequencing risk, longevity risk and specific estate goals. Lifestyle (and spending habits) is a personal thing. What one might view as luxury living could be a modest living for another. The first step is determining how you want to spend your retirement and only then can you map out a strategy designed to fund that ideal lifestyle and make sure your money lasts longer than you do.

This is the basis of our investment philosophy – Liability Driven Investing. Unlike traditional ‘one-size-fits-all’ investment methods, this approach is an actively managed, highly personalised goals-based and risk-aware methodology to building investment portfolios. It’s essentially all about understanding what a person’s annual lifestyle liabilities (costs) are and designing an investment strategy that delivers the required cash flow to fund these comfortably. Stuart and Miranda’s story below illustrates how this approach works.

Case study: Stuart and Miranda’s retirement plan

Stuart and his wife Miranda are both 65 years of age and are planning to now retire. Having spent most of their life working, looking after children and paying off their mortgage, the couple has chosen to spend their retirement years with their family but take a trip overseas each year so they can travel to all the places they were unable to during their working life.

Based on a life expectancy of 25 years, it was determined that Stuart and Miranda’s retirement goals would be:

• $130,000 per year retirement income

• $20,000 per year to cover travel expenses

Based on an average return assumption of 7%, we calculated that Stuart and Miranda would need approximately $2,170,000 at retirement in order to achieve these goals.

Fortunately, Stuart and Miranda had saved up more than is required – $2,960,000. As a result of this, the couple is able to either take a more conservative investment approach and lower their investment risk or set the surplus capital aside for another purpose, such as:

• Funding grandchildren’s education

• Longevity allowance for 10 years after retirement income

• Motor vehicle upgrade

Increasing life expectancy and the current low return environment makes it even more important to start thinking about retirement sooner rather than later. Furthermore, the earlier you take this step, the easier it will be for you to take advantage of compounding returns. Whether you’re just starting out in your career, are at the prime of your working life or are planning on retiring within the next few years, make it easier for yourself by investing some time now in thinking about what you want to do after your working life. Determine when you want to retire and the kind of lifestyle you want for your life after work. Once you know this, discuss with your adviser whether the assets you have now will provide the income you need to fund this. If not, you can work with them to map out a financial strategy that will get you there. Your future self will thank you.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice.