Today (3 September), the Australian All Ordinaries share market index and the US Dow Jones index are down 14% and 3% from their respective February 2020 highs, due to the Global Health Crisis.

In mid-February, the market fell “fast and sharp” – more drastically than other stock market crises, including the Global Financial Crisis (GFC) (2009), September 11 (2001), the tech bubble (2000), the 1987 crash, the 1974 oil shock, and the 1929 crash. During the month of March, the stock market was very volatile and on 17 March, we read headlines like:

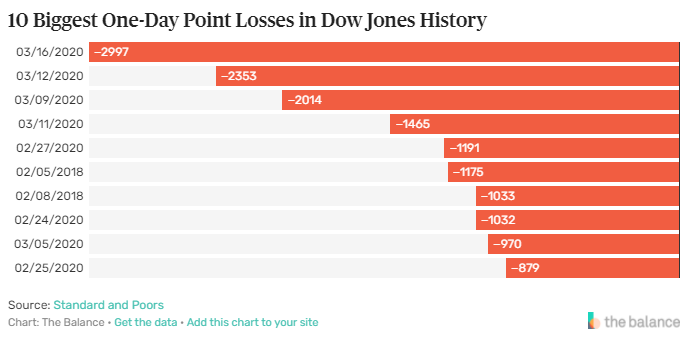

The day before (16 March), the Dow had reached a new record (for all the wrong reasons) – it lost 2,997 points to close at 20,188. That day’s point plummet and 12.93% freefall topped the original October 1929 Black Monday slide of 12.82% for one session.

By 23 March, the All Ordinaries and Dow Jones indices had fallen 37% from their respective highs; the chart below taken from The Balance shows the severity of the volatility. In March alone, the Dow experienced 5 of its 10 biggest one-day point losses in history.

Then, on 24 March, the Dow Jones entered a bull market, climbing 1,350 points and enjoying its fourth best day since 1933!

Governments and central banks around the world put “circuit breakers” in place via monetary and fiscal policy measures, reducing interest rates to close to zero and implementing huge quantitative easing programmes.

For the quarter ending 30 June, the US Dow Jones and S&P 500 posted their strongest quarterly return since 1987, returning +20%. The recovery has been led mainly by Info Tech and healthcare stocks. The top 5 in the S&P 500 (the “tech titans” or the “S&P 5”!) are now up over 95% from their March trough and the remaining 495 companies are still -10% below their February peak.

So far it seems like we’ve seen a “tech recovery”, rather than an “economic recovery”.

No one could have foreseen COVID-19 and its impact on the share market – indeed, it has been a “black swan event”, an “unknown unknown”. However, events like these have happened before; they’ll happen again. It is always the unexpected that causes dislocations in markets.

Today’s release of the June national accounts revealed how the Australian economy contracted by 7% through the quarter. That’s the worst result we’ve ever seen. Many factors still pose a challenge for the economic recovery – border closures thwart economic activity but conversely, some analysts argue that the re-opening of borders and businesses without virus containment is not conducive to households and companies normalising their spending. What will happen when the JobKeeper programme finishes? What will happen when the extra liquidity in the system is absorbed? How and when will our businesses rebound as demand slumps? Will trade, migration, and travel “normalise” and if not, how will that affect markets? What are the inflation risks?

So many uncertainties exist which affect how the COVID-19 recovery will play out. But there are always market concerns.

Structuring a Resilient Portfolio

In a recent “Your Life Choices Survey”, it was found that the top fear among retirees was losing retirement savings as a result of a fall in the market.

Sequencing risk models (that examine the impact of the order and timing of investment returns) highlight the need to construct pension and pre-retirement portfolios differently and the need to hold a certain level of liquid or conservative assets. Structuring your (pre) retirement portfolio properly can increase the longevity of your retirement capital, particularly for women who statistically have lower balances.

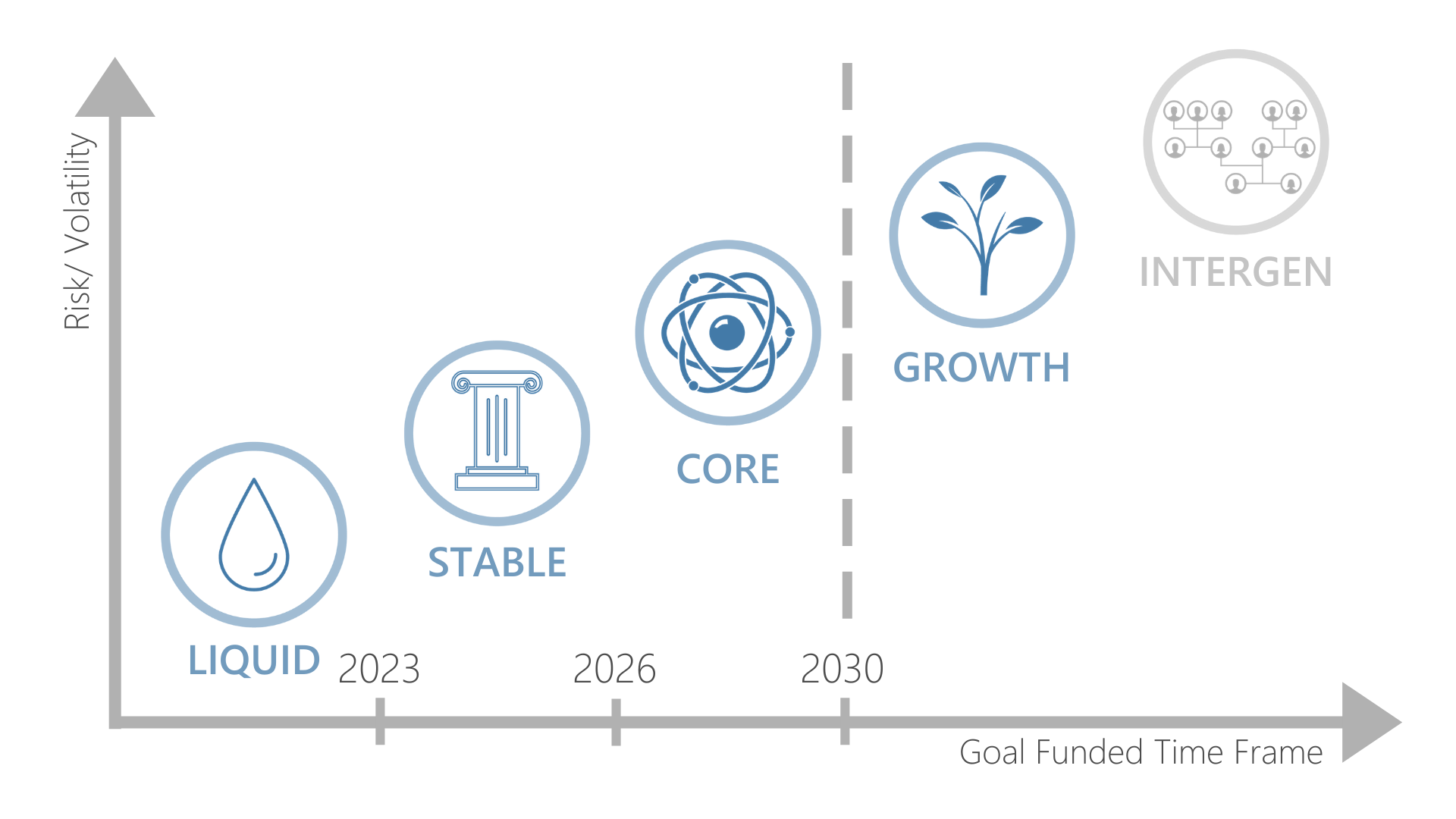

The right portfolio strategy design (“goals-based investing”) focuses on the cash flow demands on your portfolio – based on foreseeable expenses and capital costs. What do you expect to draw from your portfolio and when?

That information (which is unique to each person) helps determine the minimum weighting to various investment types within your portfolio so that assets can be invested for the optimal time period.

Your requirements are then matched with investments which are most suitable for the specified time frames.

This process reduces the possibility of having to sell down longer-term investment units (like units in international share funds) at potentially reduced prices to fund drawing requirements or pension payments.

The diagram below explains how the portfolio contains investments along the risk continuum.

Uncertain times like these are a reminder to reflect and determine what you want to achieve, and ensure you have built contingencies into your portfolio and adopted a goals-based investing approach. This will ensure your portfolio is resilient to unexpected challenges but structured to provide you with the returns you require. This is an important consideration for all age groups and demographics, but particularly relevant for those nearing or in retirement and women who generally have lower superannuation balances.

Please get in touch if you would like any assistance with your investment strategy.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice.