To keep up to date with more articles like this, join Connect the Dots.

Superannuation has long been hailed as the best tax structure in Australia and many have embraced it as a preferred means of building long-term wealth. However, it isn’t the only long-term investment option available and with the impending legislative changes limiting how much can be entered and invested into superannuation, now is a good time to review the next best option.

Typically overlooked in the past due to the far more generous tax breaks offered by superannuation, insurance bonds are a simple, tax-effective investment vehicle and can be the foundation for multiple strategies across wealth savings, education funding, estate planning, pension income as well as aged care. Due to the array of benefits insurance bonds offer, we will be posting a series of articles over the coming months to break down insurance bonds and help you understand how they can be integrated into your financial strategy. Today, we’ll start with the general framework.

What is an insurance bond?

Insurance bonds (also called investment bonds, growth bonds, imputation bonds or education bonds) are ‘tax-paid’ investments offered by life insurance companies where earnings are taxed at a maximum rate of 30%. Widely used throughout the UK, Europe and Asia, they are best suited for long-term investors with features, fees and returns broadly similar to managed funds (albeit the underlying investments are held within the structure of a life insurance policy and being tax-paid we tend to find the after tax rate of return for our clients slightly better). One of the most attractive benefits of insurance bonds is that the funds are not locked away, as they are with superannuation, and funds can be withdrawn as a lump sum or as an annuity-like income stream at any time. Most insurance bonds offer investment options including cash, term deposits, fixed interest, shares, property, infrastructure or a range of blended, diversified investment options, each with its own level of risk. Technically, an insurance bond is a life insurance policy and thus can be owned individually, jointly, via a trust or company or Partnership, allowing complete flexibility for a wide variety of strategies.

Is an insurance bond right for me? An insurance bond may suit you if:

1.You are looking for a tax effective investment structure

2.You want the option of accessing your money at any time as a lump sum or an annuity-like income stream

3.You are looking to invest on behalf of your child or grandchild

4.Your marginal tax rate is higher than 30%

5.You are looking for a wealth transfer solution

What makes insurance bonds so favourable?

Tax-Paid Investing

Insurance bonds are tax-paid investments, meaning the earnings on the investment are taxed at the corporate tax rate of 30% before being reinvested in the bond. For those with a marginal tax rate higher than 30%, this makes insurance bonds a very attractive, tax-effective investment tool. Investment earnings inside the insurance bond do not need to be included in your annual tax return (unless you make a withdrawal within the first ten years – and even then an offset applies representing the tax already paid on your behalf).

The ten year rule: after ten years of contributing to and holding an insurance bond, the investment is entirely tax free upon withdrawal.

Accessibility

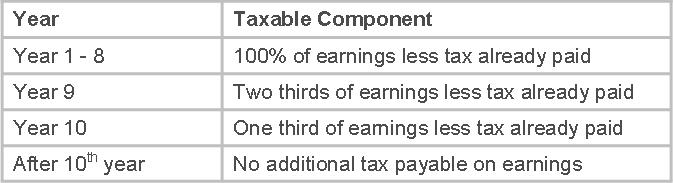

Unlike superannuation funds, money can be withdrawn from an insurance bond at any time. However, if you make a withdrawal before ten years, there may be tax implications, and the rate you are taxed will depend on which year you made the withdrawal, as seen in the table below (note: a 30% tax offset applies to the taxable component of any withdrawal).

Estate Planning

Insurance bonds offer the freedom to nominate anyone as a beneficiary. In the event of death, the beneficiary receives the proceeds from the insurance bond tax free. If no beneficiary is nominated, the proceeds will instead go to the policy owner or the policy owner’s estate. We have put together a case study which examines this. As a low cost non-estate asset, insurance bonds are very useful in making simple bequests for the benefit of family, friends and charities.

Investing for Children and Grandchildren

A child advancement policy is offered on most insurance bonds, where policy ownership can be transferred to a child once they reach a nominated age. This is an attractive way to save for a child’s future. A unique sub-class of insurance bonds, known as an education bond, will be explored in the coming weeks where we show you how to make certain schooling expenses tax deductible (such as fees, text books, musical equipment etc.)

Unlimited Contributions

Contributions to insurance bonds are unlimited, unlike superannuation funds where concessional and non-concessional contribution caps are in place.

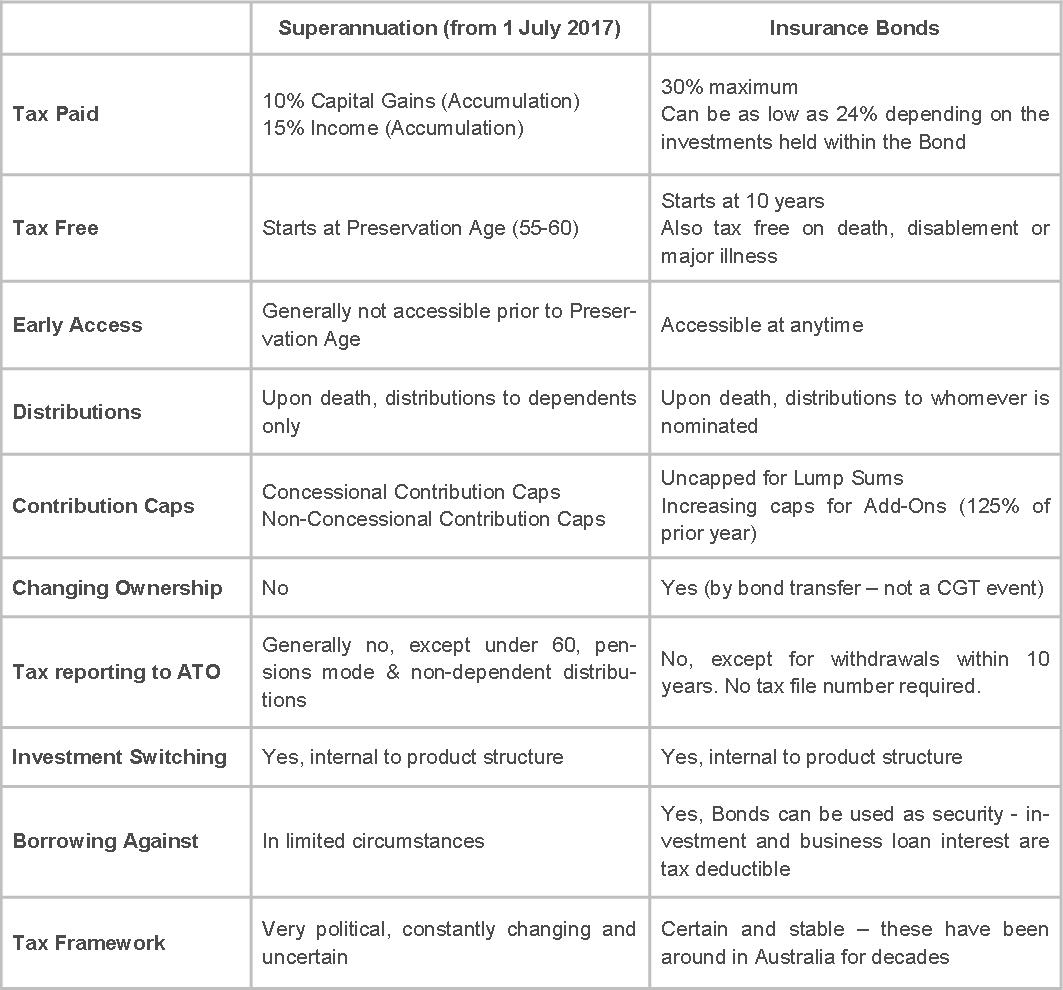

So, how do insurance bonds compare to superannuation?

If you would like some more information on insurance bonds, or would like to discuss your superannuation and investment strategies more broadly, please don’t hesitate to contact us on (07) 3391 5055 or advice@mgdwealth.com.au. Over the next few weeks, we will be going into more depth in the various tax-effective strategies insurance bonds offer. Watch this space.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice.