Many individuals view life risk insurances as something very low down on the financial priority list – only really considering it after a major life event occurs (such as a new mortgage or the birth of a child). However, leaving it too long may cost your future self (or your children) money and potential difficulties. So before you step into 2017 full of ambition and determination to make it your best financial year yet, now may be a good time to consider getting your basic protection strategy down pat, and understand how life insurance could influence your financial future.

So what is the value of purchasing life insurance sooner rather than later?

Save money in the long run

When purchasing life risk insurances (death, total & permanent disability, trauma & income protection), the cost is dependent on a number of factors such as age, sex, occupation, smoking status, income, sum insured and, of course, your broader health. All else being equal, the younger you are, the cheaper the premiums will be and the more likely you are to obtain cover on standard rates and terms. Premiums will rise as you age and if you develop health issues. So while you are younger and less likely to have any pre-existing medical conditions, it may be a sensible strategy to consider your life risk insurance position as you can potentially lock in an age based premium rate which will be much cheaper than if you wait until you’re older.

Equally, if you are a retiree with adult children, it is important you have the risk insurance discussion with your children (or even take out a policy on behalf of them) so if a disablement event occurred to one of your children, like a motor accident or a major illness, it wouldn’t impact your lifestyle in retirement or become a financial burden. Costs of part time care for a loved one can stress out even the most well intentioned retirement income strategy ($27,000 + per annum).

When taking out life insurance, you can typically choose between two types of premiums:

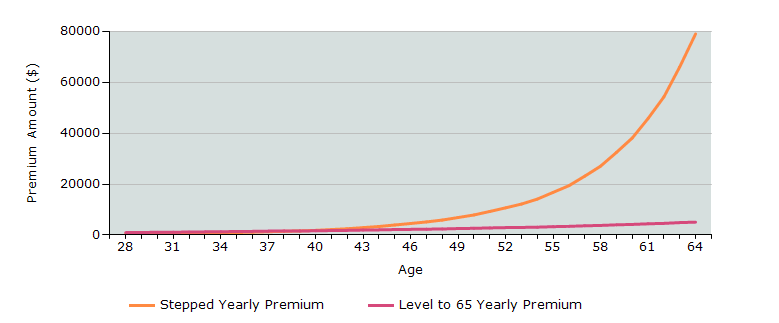

1. Stepped premiums – this premium type increases each year as you get older and according to your circumstances. While this option will be more affordable in the short-term, it will increase each year and become costly in the medium to long run.

2. Level premiums – this premium type provides you the option to lock in your age based rate at inception. Initially, level premiums will generally be more costly than stepped premiums, however it can save you money in the long run.

To help you compare the long run costs of stepped vs. level premiums, we thought it best to include a case study. Felicity Jolly is a 28 year old non-smoking Sales Manager who requires $300,000 of life, total and permanent disablement and trauma insurance. She envisages needing to hold this cover into her late 50s and so she wants to understand her options regarding the long run cost of cover. The stepped premium vs. level premium comparison reveals the following:

Initially, Felicity would pay roughly $1,000 per year if she chose level premiums or $600 per year under a stepped premium structure. However, by the time Felicity turns 58, she would have spent $191,979 via a stepped premium structure whereas with level premiums, she would only have spent $65,951 (saving $126,028 over the 30 years she chose to hold the policy). This shows how important it is to consider obtaining life insurance early and the merit of considering level premiums over stepped premiums for your long run needs.

Insurability

As your circumstances change, so too will the price and your eligibility for life insurance. Depending on your health, you may not be eligible for life insurance later on in life. If you purchase life insurance at a younger age, you are far more likely to be accepted at standard rates and terms compared to someone much older.

It is impossible to know what the future holds and while you and/or your adult children might be in a good health condition now, no one is immune to illness or injury and no one can stop the age clock. It is worth taking care of potential future life insurance needs sooner rather than later.

We are here to help if you would like some assistance in determining whether life insurance could add value to your financial plan or if you need a hand navigating through different life insurance options for yourself or your adult children. Please don’t hesitate to contact us on (07) 3391 5055 or write to us at advice@mgdwealth.com.au.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice.