This is a question we’re commonly asked.

The answer depends on your age, your income (or more specifically, your marginal tax rate), interest rates, investment returns, whether you have an adequate cash reserve and your situation, generally. Both options have advantages and disadvantages.

Let’s firstly cover some basics

Repaying your home loan reduces your overall debt, the interest payable and the term of the loan. Increasing the equity in your home increases your ability to leverage from that equity (i.e. use it for collateral) to fund other investments.

If you want access to these funds later, then check the flexibility of your mortgage package and whether you can re-draw the funds. Otherwise, a mortgage offset account might be a sensible way to go.

Your home is one of the few capital gains tax exempt assets you can own – should you sell it and make a capital gain, that gain is not taxable.

Contributing to super enhances your prospects of building up your retirement nest egg and having a more comfortable retirement.

However, contributing to super may not give you much flexibility or ability to access your capital, depending on your age. That’s because all super contributions are “preserved” and must remain in the super “system” until you meet a “condition of release”. Generally speaking, someone who is less than 55 needs to wait until age 60 to access their funds. So consider whether you might need these monies anytime soon.

Within the super structure, you have the ability to make investment decisions in line with how much risk or volatility you’re prepared to accept. If time is on your side and you’re young, then you’ll most likely benefit from the power of compound interest.

It may be possible for you to claim a tax deduction for making a super contribution. As such, a 15% tax would be applied to the contribution on the way into the fund. The sense of doing so depends on whether your tax rate exceeds the 15% rate. The alternative is for the contribution to be treated as a non tax-deductible one and not attract the 15% tax on the way into the fund.

One important point to bear in mind

Always be careful when comparing mortgage repayment rates (which are paid from after-tax dollars) to investment rates (which are returned in before-tax dollars). For example, someone earning more than $180,000 p.a. [who is paying tax at the top marginal tax rate of 47%], paying interest on their home loan at 5% p.a. must achieve a 9.43% p.a. risk-free return from an alternative investment before they’d consider investing outside of their home loan. The closest proxy to a risk-free return is a ten year government bond and its rate is currently only 1.36%! So a risk-free 9.43% isn’t too achievable right now.

Now let’s take a look at the maths

We’ve considered two individuals – Sam and Jamie. They each have the capacity to save $6,000 p.a. They each have a home loan with a 5% p.a. interest rate and they are each faced with the choice of either:

1. Making extra loan repayments of $6,000 p.a.

2. Making tax-deductible superannuation contributions of $6,000 p.a.

3. Making non-tax-deductible superannuation contributions of $6,000 p.a.

Sam earns $200,000 p.a. and Jamie earns $70,000 p.a.

Their super funds could earn either 5% p.a. (2% income & 3% capital growth) or -5% (2% income and -7% capital growth).

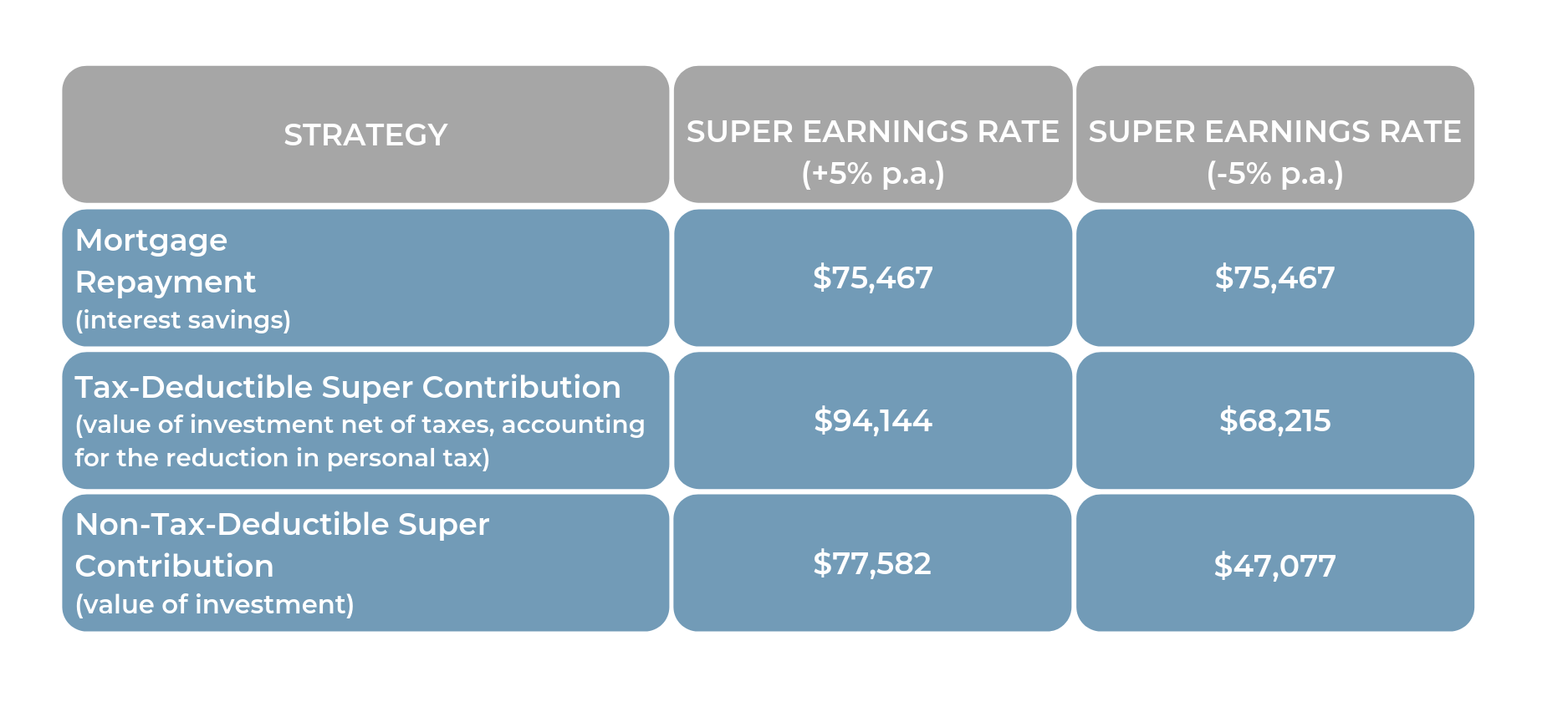

For Sam, the comparison of savings after ten years amount to:

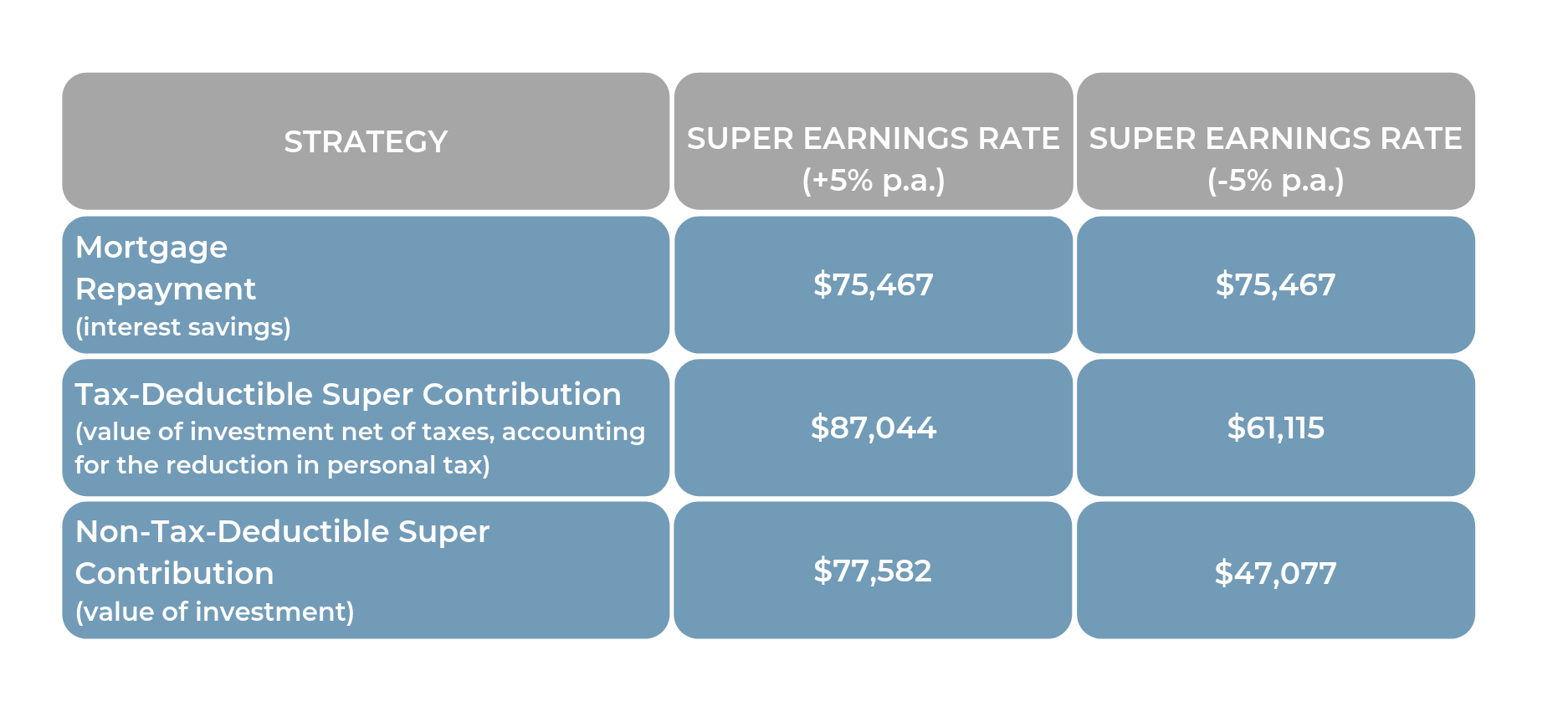

The comparison for Jamie is a little different:

In essence

• Reducing your mortgage is more feasible when investment returns are low or negative;

• A higher tax-payer generally gains more from making tax-deductible super contributions, although the gain is less in times of negative investment returns;

• A lower tax-payer definitely gains more from making extra mortgage repayments in times of negative investment returns.

Overall summary

Consider your financial situation. The only “perfect” answer is one that suits your circumstances and your comfort level. If you’d like to have a chat about various strategies, or would appreciate a fresh perspective on your current strategy, please get in touch.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice.