MGD

Client Portal

The MGD Client Portal (Portal) enables you to manage all aspects of your financial life in one location. You can securely store, access, and share important documents with added digital signature functionality where required. It will allow you to easily collaborate with your MGD advisory team and, if you choose, view your assets and liabilities at any time, and track transactions and cash flow movements on your bank account.

1.0 Account set up

You will be invited to activate your account on the Portal using your preferred email address. You will set your account up yourself with an email address and password of your choice.

Once you have been invited to activate your account, there will be two ways you can access the Portal: via the MGD Wealth app or your web browser.

2.0 MGD Wealth app

To access the Portal through the MGD Wealth app, download the MGD Wealth app from the Apple App Store or the Google Play Store, depending on your personal device.

Click here to download the app from the Apple App Store. This option is suitable if you own an Apple device, such as an iPhone or iPad.

Click here to download the app from the Google Play Store. This option is suitable if you own an Android device, such as an Android smartphone or tablet.

3.0 Web browser

If you do not own a device that is compatible with the MGD Wealth app, you can access the Portal via your web browser.

Click here to access the Portal on your web browser.

A note for current myprosperity Portal users: the MGD Client Portal is built in the myprosperity Portal. You can access the MGD Client Portal through the MGD Wealth app or your web browser using your existing myprosperity Portal login details.

4.0 Security

We have partnered with reputable Australian provider, myprosperity, to assist with the development of the Portal. Myprosperity uses multiple layers of security controls to provide the highest level of protection to users and their data, including secure digital signing and document storage. For example, the platform uses the same 256-bit encryption and physical security that is used by banks to protect your personal information.

Additional security can be applied by enabling multi-factor authentication.

Lastly, as a read-only service, there is no transactional functionality on the Portal to move or withdraw funds.

You can read more on myprosperity’s security measures here.

Please note: as a default, your adviser will have access to your data; however, you can tailor the permissions and choose what you would like your adviser to be able to access and what you would like to remain confidential.

5.0 What happens if I don’t activate my account?

There is no obligation for you to join the Portal or to download the app. If you choose not to create an account, the management of your financial affairs will remain as is and without change. However, as myprosperity will become our provider of digital signature capability, you will need to access the Portal via your web browser in order to be able to sign documents digitally.

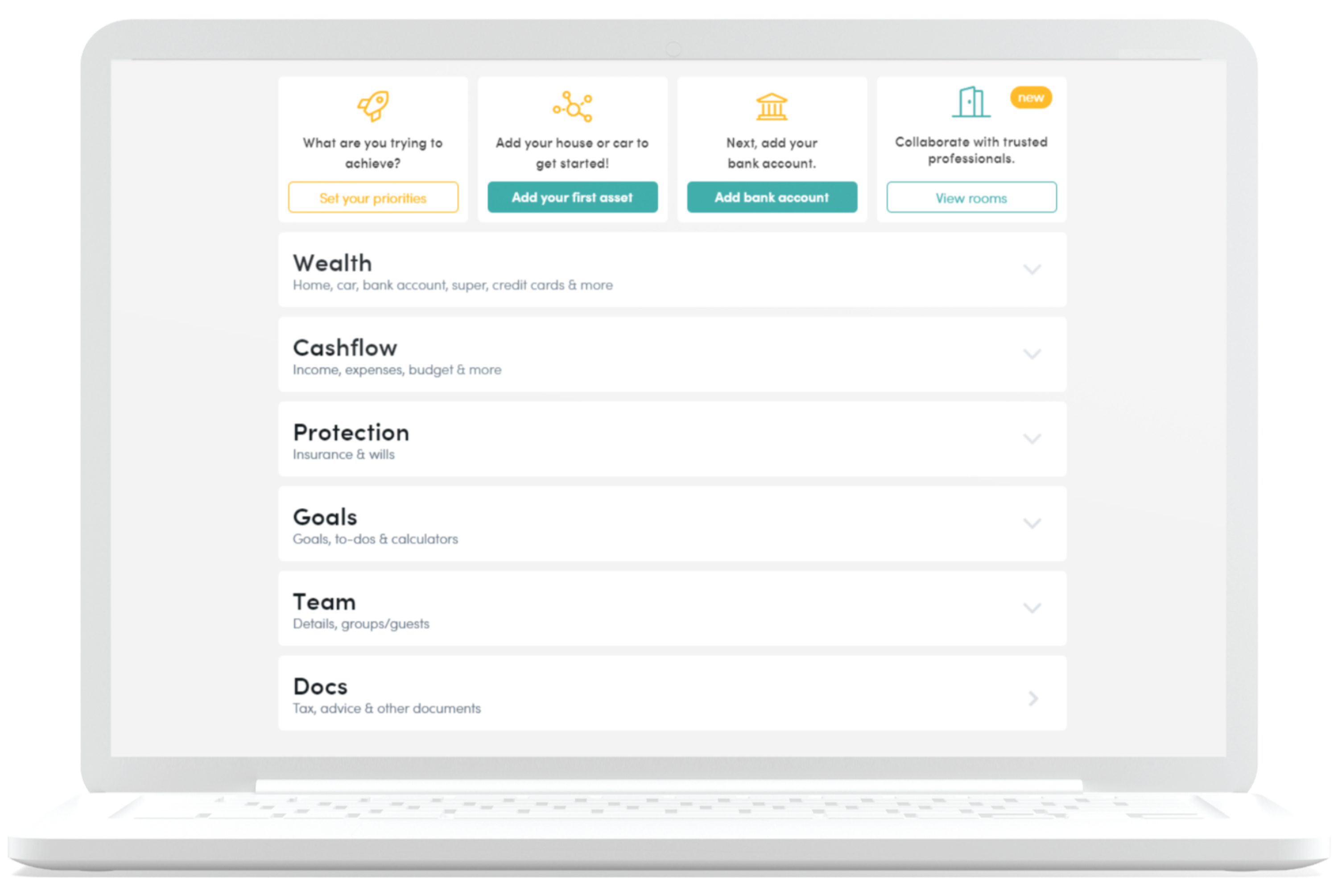

6.0 How to use the client portal

Below, you will find instructions on how to use some of the most common features available to you.

These step-by-step guides are designed to help you navigate the portal with ease and make the most out of its functionalities. Click the links below to view the tutorials.

Below are some of the features of the Portal to help keep your finances organised.

The to-dos feature provides you with a list of tasks your adviser has allocated you or you’ve created yourself. This feature fosters transparency between you and your adviser on collaborative tasks. To-dos will provide you with automated reminders when a task is due or becomes overdue.

The reports feature gives you convenient access to your financial reports on your device. The reports are generated using live data and are always up-to-date with the most accurate information. Some examples of reports you may access include your wealth snapshot or cash flow summary.

The document storage feature provides you with a secure location to store sensitive documents (for example, wills, deeds, and financial statements). Through the Portal, you will have easy access to these documents anywhere and at anytime.

The eSignatures feature enables you to securely sign important documents and forms electronically, as well as request for your adviser to sign forms and documents electronically. Through this feature, you can sign a document anywhere, anytime, and from any compatible device.

The rooms feature allows you to collaborate with your adviser by setting and updating your priorities and requesting help with any issues you may be experiencing. This feature also provides a chat function that allows you to communicate effectively with our team.

Below are a few additional features available to Portal premium account holders. These features provide you with a holistic view of your finances. If you would like to upgrade to a premium account, please contact your adviser.

The premium cash flows feature provides you with a live cash flow tracker which auto-categorises your transactions. This feature helps you keep up-to-date with and track your income and expenditure.

The premium budgets feature provides you with the necessary tools to assist you in staying on course to reaching your personal financial goals through budgeting. This feature enables you to track your income and expenses to meet your planned budget goals.

The premium goals feature allows you to list and track in real-time your financial goals for the near future or further down the track, whether this be savings, retirement, or a holiday. This feature helps you stay on track to achieving your financial goals by keeping the end in mind.

The premium balance sheets feature lets you maintain a real-time view of your bank accounts, loan accounts, superannuation accounts, and investment portfolios. This feature allows you to easily live track all your finances in one location.

The premium valuations feature is a comprehensive asset management tool that offers you live data feeds. The feeds provide you with current valuations of your properties and assets (for example, homes and cars).