Residency and Taxation is chapter one of our upcoming eBook, A Comprehensive Guide to Repatriation for Australian Expats, which has been designed to help Australian expats make a seamless re-entry back to Australia. We hope you enjoy this exclusive preview that covers material that is foundational to financial success when repatriating. If you would like to receive future chapter previews ahead of the release of our ebook, we invite you to register your interest here. Upcoming chapters deal with proactive currency management, the complexities surrounding foreign retirement accounts, and an overview of the various Australian investment structures available.

Our experience advising Australian expats

For more than four decades, we have advised Australians on a successful path; executives, professionals, and business owners, whether residing in Australia or overseas. We offer integrated financial advice to individuals that encompasses tax planning as an essential component. Our approach focuses on providing comprehensive guidance for clients in achieving their financial goals through financial planning, wealth management, and tax planning. Being engaged to only provide specialist tax advice relating to repatriation is not something we do. We leave that to specialist accountants and lawyers who practice solely in that space and who are engaged by clients solely for that purpose. Many of our clients have successfully repatriated from various regions, such as Europe, Asia, the Middle East, and the USA. We have extensive experience in assisting individuals transitioning to the Australian taxation system with our integrated advice capability.

An essential component of a financially sound return to Australia is having a clear idea of the Australian tax system and the strategies that you might use to legally reduce your Australian tax, both while overseas and when you return.

In our experience, failing to undertake any tax planning prior to repatriation may, and quite often does, result in high and unnecessary tax payable by a taxpayer – costs that could have easily been avoided with some timely forward tax planning.

Why is tax planning essential when repatriating?

When it comes to tax planning, it’s a matter of determining who is an Australian tax resident, what defines tax residency, and when is the optimal time to recommence this status in the context of an individual’s financial life.

There is no doubt that the Australian tax system is a more onerous and costly one in comparison with many taxation regimes overseas, particularly where those countries have no tax on either earned income, investment income, or capital gains. Hence, it is essential for expats and their families to understand when and how the Australian tax system will apply to them.

The first principle is to assess that as an expat, you are actually a non-resident for tax purposes. That is not always the case, depending on a range of factors discussed further in our ebook.

The second principle is that from the date of resuming Australian tax residency, you will join fellow Australian tax residents and become liable for tax on your worldwide income and gains. Also, Australian-sourced income that may have previously been subject to withholding tax will now be fully assessable.

The third principle is that for future capital gains tax assessment purposes, you will need to value all your assets (except those that are already Taxable Australian Property) at the date of resuming tax residency.

Therefore, a central part of the planning process is to evaluate and decide whether to keep assets in foreign countries or to sell them before resuming residency. Further, prior to returning to Australia, good planning also involves making decisions and building an Australian asset base that meets your goals and is tax efficient in Australia on a go-forward basis.

Your planning should also take into account the taxation, if any, applied by foreign countries to the income and gains you may derive in those countries. Australia has tax treaties with many countries throughout the world that may lead to the reduction or elimination of tax in one jurisdiction where tax is paid in another.

Generally, it may be preferable to restructure your portfolio while you are a non-resident than to deal with the complexity of valuation and future taxation relating to legacy assets in foreign jurisdictions.

Income Tax

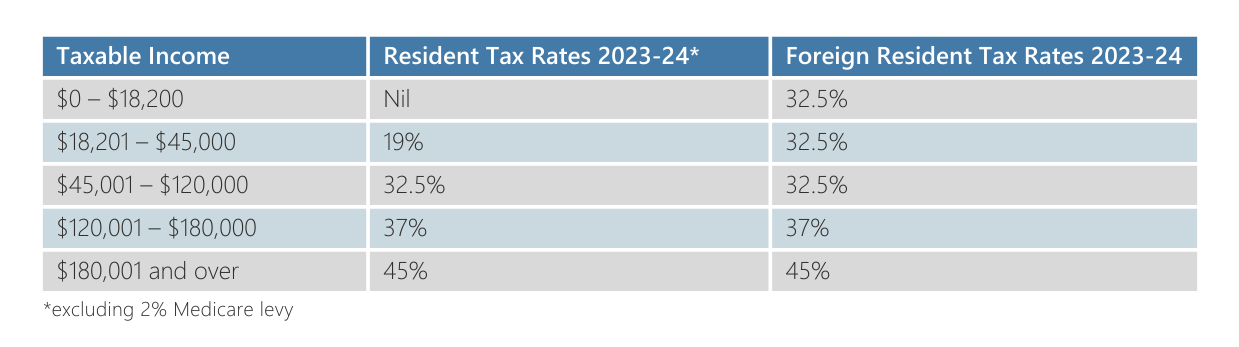

The Australian tax system is ‘progressive’ in that the more you earn, the more you pay. The following table shows the tax payable on income for residents and non-residents. Note, there is no such thing as a joint tax return in Australia (one return for a couple), although there are various tax thresholds and offsets that apply for couples depending on income.

We can draw a couple of basic conclusions from the above:

- Who owns the assets (self, partner, joint, etc.) determines who pays the tax and at what rate.

- Investment income and capital gains are added to earned income, so good planning involves thinking about asset ownership and structure right from the beginning.

- Timing of the receipt of income or capital gain matters as there can be a big difference in tax payable if investment income is received, for example, when you are working and have a higher marginal tax rate (MTR) than when you take a year off or retire and have a lower MTR.

Capital gains tax (CGT) adds complexity to the above, but for resident individuals, CGT is easiest thought of as a form of income tax where:

- Profit from the sale of an asset is treated as income in the year the the profit is made1.

- If the asset is held for more than one year, then the assessable amount of the profit is reduced by 50%.

- The 50% reduction only applies where the taxpayer has been a tax resident of Australia.

-

- For example, where an expat buys and sells an Australian investment property bought after 8 May 2012, all while a non-resident, then none of the profit will be eligible for the CGT discount. Where the taxpayer has been both a non-resident and a resident, then the profit on such a property bought after 8 May 2012 will be proportioned over the respective time periods, and the profit relating to Australian tax residency will be eligible for the CGT discount2.

-

With an effective individual top marginal tax rate of 47% (45% plus 2% Medicare levy), it is critical for expats rejoining the Australian tax system to understand when and how tax will apply and take advance planning measures to manage their position.

Taxable Australian Property (TAP)

Australian expats need to also be aware that some assets are classified as Taxable Australian Property, being assets subject to CGT assessment, whether or not the owner is a tax resident.

Most usually, Taxable Australian Property is real residential or commercial property but can also include:

- Mining, quarrying, and prospecting rights if the underlying materials are located in Australia;

- CGT assets used in carrying on a business through an Australian permanent establishment;

- Indirect interests in Australian real property; and

- Rights or options to acquire any of the above.

Also, there is a way that other assets, such as shares or managed funds, can become Taxable Australian Property. If you stop being an Australian resident, you are taken to have disposed of each of your assets that are not Taxable Australian Property for their market value at the time you ceased being a tax resident.

You have the option of disregarding capital gains and losses at that time. If you do this, your assets will be taken to be Taxable Australian Property. For example, if you disregard the capital gain or loss on Australian shares you own, those shares will become Taxable Australian Property and assessable for capital gains tax in the future. As such, there is no need for a returning expat to value Taxable Australian Property at the time of resuming tax residency.

Australian tax residency for individuals

As noted above, the Australian tax system captures worldwide income and gains for an individual who is an Australian tax resident. Let’s now review the often tricky and pivotal subject of when tax residency resumes.

Help on this very complex determination arrived in June 2023, when the Australian Taxation Office (ATO) released ‘Tax Ruling 2023/1 Income Tax: Residency Tests for Individuals’. That tax ruling provides much more clarity on the subject of Australian tax residency. The ruling explains the law and the numerous administrative and legal cases from an ATO perspective to provide guidance to individuals on whether they are tax residents.

However, more clarity does not equal clear.

One of the first points made in the ruling is that:

“residency… is determined by considering all of your relevant facts and circumstances. No single fact determines the outcome and the significance of facts varies from case to case. Because of this, there are no ’bright-line’ rules or any single factor that can be said to be paramount.”

The other key point made is that:

“you are resident if you meet any one (or more) of the tests but a non-resident if you do not meet any of the tests.”

So, before anything else, you need to consider whether or not you are a non-resident in the first instance. Usually, Australian expats who have been overseas for a number of years and set up home outside Australia will have become non-residents, but it is important to make an assessment based on your own individual circumstances.

Further, as an overarching principle, the Australian tax system is one of self-assessment. The ATO expects you to figure it out and file your tax return accordingly. It reserves the right to question, audit, and challenge your self-assessment, including the application of penalties and interest on any back-dated tax owing. With a great deal of potential downside for getting things wrong, I write this ebook knowing that for most readers, there is great benefit in planning repatriation with better knowledge and understanding of the residency and tax rules and how and when they may apply.

So, what are the residency tests in the law that the ATO expects you to understand, self-assess, and apply in relation to your tax residency status and timing?

#1: The Resides Test Under Ordinary Concepts

Under ordinary concepts, if you reside in Australia, then you will be considered a tax resident. According to ‘TR 2023/1’, the test is:

“asking whether your presence in Australia is usual and settled in contrast to temporary and casual. This is informed by both the nature, duration and quality of the person’s physical presence and an intention to treat Australia as home. Factors that commonly inform the relevant association with Australia are:

- period of physical presence in Australia

- intention or purpose of presence

- behaviour while in Australia

- family, and business or employment ties

- maintenance and location of assets, and

- social and living arrangements

No single factor is necessarily decisive. The weight given to each factor varies depending on individual circumstances”.

The resides test relates to whether you live in Australia or not. For most, it is relatively simple and transparent that when you leave a home overseas (whether owned or rented) and return to live in Australia, that you have resumed Australian tax residency on the date you land back in Australia to live. That you live in Australia will be evidenced by your prior and subsequent behaviours and actions relating to setting up life in Australia: working, living with your family, buying a home or taking out a rental lease, buying home contents or cars, joining gyms or clubs, and the like.

If you don’t want to be considered an Australian tax resident, be very careful about doing any of the above.

With good planning and forethought, the date you resume residency should be very clear. It can become ambiguous if you are a regular traveller back to Australia and there are two or more dates that your behaviours and actions might point to as contenders for the date you resumed residency. Our Australian system is a self-assessment system, so it is up to you as you file your tax return to nominate the date that you became a tax resident.

In this context, it is important to accept that the ATO is an evidence-based organisation that may review your circumstances and taxation as part of an audit perhaps years down the track. The ATO may not agree that the date you have selected is the correct one and that change could lead to adverse tax consequences and potentially a fight with the ATO involving penalties and interest on any additional tax levied. Therefore, it is best to conduct your affairs and keep detailed records to fully support your position should such an audit ever occur.

#2: The Domicile Test

A domicile is the country that a person treats as their permanent home or lives in and has a substantial connection with.

Under the domicile test, you are an Australian tax resident when your domicile is in Australia, and you don’t have a permanent place of abode outside Australia. Under Australian law, you always have a domicile and, at any point in time, you can only have one based on:

- Origin: attributed at birth;

- Dependence: where you lack the capacity to acquire your own domicile, it will be referenced to someone else (for example, a minor child’s domicile will be determined by their parent’s); and

- Choice: where a different domicile to the above is acquired voluntarily.

With choice, you will need to evidence that you have established a permanent place of abode in another country and therefore acquired that place as your domicile. ‘TR 2023/1’ explains that, among other points, you will have:

- Definitely abandoned your residency in Australia; and

- Commenced living permanently overseas with both a lawful physical presence in a foreign country and an intention to make your home indefinitely in that country (noting that permanent is not taken to mean forever or everlasting but contrasted with temporary or transitory).

The factors that evidence whether your permanent place of abode is overseas include:

- Length of overseas stay;

- Nature of association; and

- Durability of association.

The operation of the domicile test will retain people as Australian tax residents who live or work overseas on a temporary or transitory basis (even long-term), and who don’t abandon a home in Australia and establish a new home in another country. Our ebook deals with the repatriation of non-residents, so it is essential for meaning and relevance that when you read and hopefully gain some insights into the financial aspects of repatriation that you have indeed established your domicile in another country in the first place.

#3: The 183-Day Test

Under the 183-day test, you are a resident if you have been present in Australia for 183 days or more in an income year, unless:

- Your usual place of abode is overseas; or

- You do not have an intention to take up residency in Australia.

The 183 days are counted for a financial year, not a calendar year, and add all the days spent in Australia, whether continuous or not.

Many expats mistakenly believe that the 183-day test is the main test to be worried about if they travel regularly to Australia for short periods of time. However, the resides test has the greater power in that it can capture those who have been in Australia for less than 183 days based on the nature, duration, and quality of a person’s physical presence and an intention to treat Australia as home.

Conversely, those who both maintain a permanent place of abode overseas and who don’t have an intention to reside in Australia under ordinary concepts may be in Australia for more than 183 days and remain a non-resident.

#4: The Commonwealth Superannuation Fund Test

The final test only applies to individuals such as diplomats and other government employees working at Australian posts abroad, where those employees are contributing members to either the Public Sector Superannuation Scheme or the Commonwealth Superannuation Scheme. In these situations, the expat is still treated as an Australian resident for tax purposes.

How do you prepare and plan your tax affairs before repatriation?

Inadequate tax planning before you repatriate can have a detrimental impact on your finances and result in a potentially costly tax bill that in many instances can be reduced or avoided.

If you are in any doubt, it may be very worthwhile to seek professional guidance or advice.

At MGD, we recommend and help with a five-step methodology that aims to ensure that as a returning expat, you can restart your life in Australia in as financially optimal state as possible.

Current situation and planning

To plan effectively, it is essential to understand and categorise all the income sources and assets you own that will generate income and/ or capital gains and be subject to resident tax rates upon return to Australia. These assets include worldwide income, including foreign wages, investment income from property and shares and mutual funds or trusts, and the nature and benefits of foreign retirement accounts, to name the main ones.

We seek details that matter, such as who owns the assets and their location, acquisition date, and most importantly, what tax implications are likely to occur after repatriation. The latter often relates to the employment and investment intentions of the person repatriating and whether a tax treaty exists between Australia and a country or countries where assets are held, or income is generated.

A key part of repatriation planning is figuring out what assets, including currency, you might dispose of before resuming residency, what assets you will retain, and what your intended capital structure will be as an Australian tax resident. It is quite common and advisable in many cases for expats to dispose of some assets before resuming residency so that they have capital available to purchase a new home in Australia (or renovate a property already held) and to apply focus to contributing to and building tax-effective Australian superannuation.

Having a detailed understanding of a person’s current situation and plans for life back in Australia allows MGD to foresee potential tax consequences and to start tax and capital structure planning for the best possible outcome for our clients.

Valuations

All assets that are not already Taxable Australian Property are deemed to be acquired at the date of resuming tax residency. Hence, they need to be correctly valued, as when those assets are sold in the future, then any gains or losses will be assessable for taxation. Most often, assets that need valuing include property, shares (and options), investment funds, ETFs, currency, and collectibles.

Listed investments and currency are relatively easy to value as market data is widely available. Property and collectibles generally need a statement from an accredited valuer. Getting the right market values in place at the time of resuming residency helps avoid problems in the future and allows us to advise our clients on strategies to reduce CGT, including the timing of an asset sale and what deductions may be available to reduce the amount of tax payable.

Foreign superannuation funds also need to be valued as there are particular Australian tax rules that apply to the transfer or redemption of foreign superannuation funds after resuming tax residency (see Chapter Three on foreign retirement accounts).

Expats should be aware that upon resumption of residency, individuals are once again eligible for the CGT discount on assets held for more than one year.

Resumption of tax residency

Simply put, the start date matters. Whilst the tax planning portion of repatriation can be complex, notifying the ATO that you have resumed your Australian tax residency status is straightforward and done via the first tax return lodged for the income year of resuming residency.

However, whilst the declaration of a date is simple, the date itself needs to be supported with evidence that:

1. You were a non-resident beforehand (per the four residency tests); and

2. You have, in fact, resumed residency on that date and not another.

Documentation

Timely recordkeeping in relation to your financial affairs and residency position matters for two reasons:

1. It is just simply easier to plan, work with a financial or tax adviser, and file your tax returns when you have accurate records, and not rely on memory or having to go back years to find out information. If you are ever questioned or challenged by the ATO, then it is your written evidence and documentation that can support your self-assessment.

2. Thinking you are a non-resident is not the same as actually being one! Your records need to support your position. There should be no ambiguity about the date you resume residency because you lack the evidence to support your own assessment.

Professional support on defense

Whilst proactive tax planning is central to achieving an optimal financial start back home, protective measures may be just as important when an expat has more complex circumstances and is unsure about their residency status or timing.

Some protection may be gained by seeking and obtaining written advice on your position from a qualified tax or legal adviser. A letter of advice is a valuable tool, as it confirms the expat has obtained advice and done what they can within their ability to ensure their self-assessment is reasonable. While the ATO may ultimately take a different view and apply a differing tax assessment, having a reasonably argued position can lead to the avoidance of ATO penalties and interest.

If you seek greater certainty on your tax position, you can apply to the ATO for a private ruling on your situation, usually with the support of a professional tax or legal adviser.

Board of Taxation review and proposals to change Australian residency laws

In the May 2021 Federal Budget, the Treasurer at the time, Josh Frydenberg (LNP), announced proposed changes to Australia’s tax residency rules. The proposed changes are based on a review by the Board of Taxation which commenced in 2017 with its report delivered in 2019 to simplify Australia’s individual tax residency rules. Click here to access the report.

In July 2023, the Australian Treasury released a Consultation Paper in which the government is seeking feedback on the proposed changes. Click here to access the Consultation Paper.

The discussion paper builds on the Board’s report with the government’s goal to make tax residency much simpler and objective by implementing a two-step approach to determining if someone is resident or not:

Step 1 – Primary Tests:

- The 183-Day Test: If a person has resided in Australia for 183 days or more, they are an Australian tax resident (a bright line test); and

- The Government Officials Test: Government officials deployed overseas are tax residents throughout their deployment.

Step 2 – Secondary Tests:

- Commencing Residency Test: If a person has previously been a non-resident but in the current income year, they have been physically present in Australia for 45 days or more but less than 183 days, then they may be an Australian tax resident if they satisfy two or more of the following factor tests, where they have:

-

- A right to reside in Australia permanently;

- Australian accommodation;

- Australian family; and

- Australian economic interests.

-

- Ceasing Residency Test: If a person is a tax resident, they may become a non-resident if they meet one of the three ceasing residency rules:

-

- Overseas employment rule: applying to long-term residents who take up employment overseas for at least two years;

- Ceasing short-term residency rule: applying to individuals who have been resident for less than three income years; and

- Ceasing long-term residency rule: applying to individuals who have been resident for three or more income years.

-

Details of the above proposed tests can be found in the links provided above to the Board of Taxation’s Report and Treasury’s Consultation Paper.

Given the whole framework of tax residency is now under review, if you are a current or intending expat who may have significant ongoing family or economic ties to Australia, it is definitely appropriate to watch this space and contemplate how you might adjust your situation and plans if the proposed changes are legislated in the future.

Tax advice differs from financial advice. You should consult a financial adviser about financial advice and a tax professional/ accountant regarding tax matters. Richard Marsden is a Financial Adviser and a Representative of MGD Wealth Ltd, AFSL no. 222600, who is able to provide financial advice. The tax content in this publication was reviewed by qualified tax professionals working with MGD Wealth.

Any advice included in this article is general and has been prepared without taking into account your objectives, financial situation or needs. As such, you should consider its appropriateness having regard to these factors before acting on it. Before you make any decision about whether to acquire a certain financial product, you should obtain and read the relevant product disclosure statement. Any tax information in this article refers to current laws, is not based on your unique circumstances and should not be relied on as tax advice.

1 Assets that were purchased before 20 September 1985 are not subject to CGT.

2 Non-residents are eligible to discount a capital gain to 50% in proportion to the period of time before 8 May 2012 and after their resumption of tax residency.