With businesses and households around Australia suffering from the effects of COVID-19, we’ve been doing a lot of work recently for people who are being offered a redundancy, including pilots, senior flight attendants, academics, and professionals. We’ve seen how challenging it can be for redundancy recipients to assess whether they should accept a package.

Below is a simple example of someone being offered a voluntary redundancy to illustrate some of the issues you should consider when assessing if a redundancy offer is right for you.

For the purposes of this case, we’re going to assume the following scenario:

- Sue is an employee, aged 56 years; she’s single with 15 (full) years service to the organisation;

- She earns $65,000 p.a. (i.e. her marginal tax rate is 32.5% plus Medicare levy less tax-offsets);

- She receives a redundancy payment of $52,500;

- Her cash funds total $30,000 (excluding the redundancy);

- Sue is a homeowner, with no mortgage or debts;

- Her cost of living is estimated at $33,000 p.a. indexed at 3.2% p.a.; and

- She has $400,000 in her superannuation account.

The Science/ Maths

Firstly, Sue needs to understand the facts:

- The tax-free component of her redundancy is calculated according to a formula. For financial year 2020-2021, this is calculated as follows: $10,989 + ($5,496 p.a. x 15 years service) = $93,429.

- As Sue’s redundancy payment is less than $93,429, her payment of $52,500 is completely tax-free.

- According to Australian legislation, Sue cannot access her superannuation until age 60 (assuming she’s retired).

- If Sue retires, she will need to cover her living expenses (using her cash and redundancy payment) until she can access her superannuation at age 60. At that point, she’ll be able to access her superannuation but will need to fully self-fund her retirement until she turns age-pension-age at 67.

Knowing the above, Sue needs to do some calculations to determine…

- With her current salary, how long it will take her to earn an amount of money (net of tax) equivalent to her redundancy payment. The answer is about one year. This information might help Sue determine the attractiveness of the redundancy offer. If she finds an alternative job within the year, she might be better off taking it.

- Whether she has enough capital outside of superannuation to cover her expenses until she can access her superannuation. Sue doesn’t have enough capital to sustain herself until age 60. She would need to acquire part-time employment to earn at least $12,500 p.a. for the next four (4) years from age 56-60. That income, together with drawdowns of cash and redundancy, would sustain her until age 60.

- Whether she has enough capital to cover her expenses (and live the life she wants to lead) in retirement. Our projections show that Sue’s superannuation and (ultimately) Centrelink age-pension benefits will cover her living expenses in retirement. (In this calculation, we have accounted for superannuation contributions made on her behalf in her new employment).

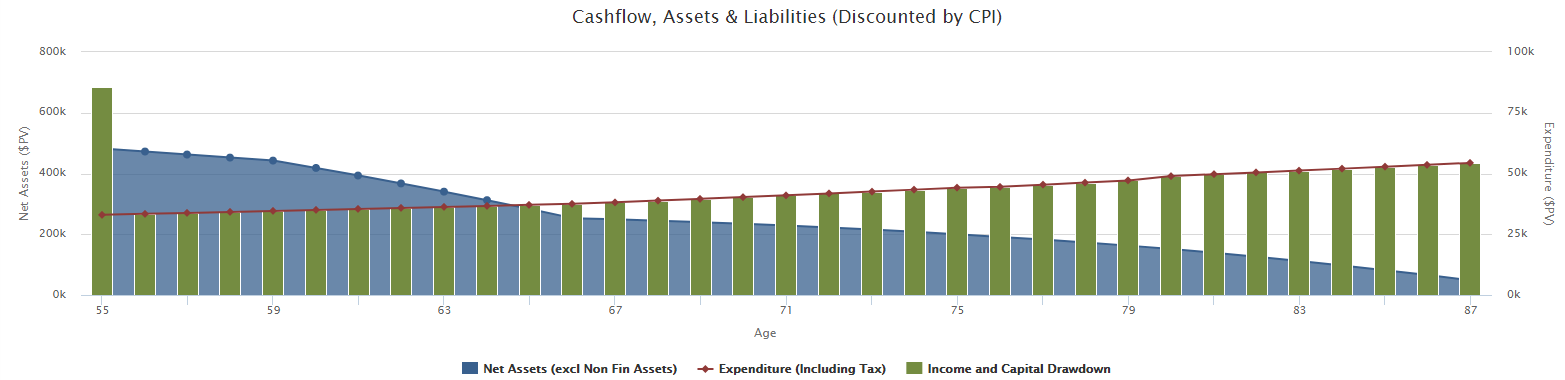

The first chart below shows two different pieces of information. Firstly, the blue line shows the value of Sue’s capital over time, through to her statistical life expectancy.

Secondly, the green columns show how Sue’s income needs are met, increasing over time to account for the rising cost of goods (inflation).

Capital Longevity and Meeting Income Requirements with Part-Time Work

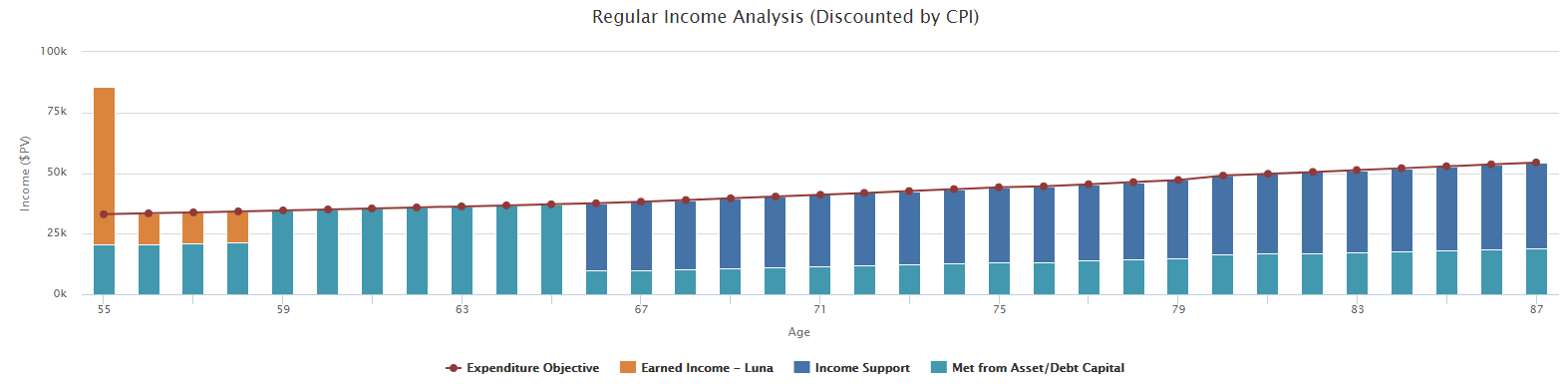

Derivation of Income with Part-Time Work

The second chart above shows how Sue’s income is derived – i.e. from employment, capital drawdowns, superannuation, and income support (i.e. Centrelink benefits).

These numbers would vary if Sue had a mortgage, a different superannuation balance, or a different cost of living, so it’s important to carefully consider your own circumstances before making a decision.

Having done the maths, Sue now needs to consider the human element/ the “art of living”.

The Art

- How is her mental state? Is she tired? Has she had enough?

- If so, then will she find another equally/ more enjoyable job if she were to leave the organisation? Especially in light of the current difficult economic environment?

- If not, then what will the workplace be like if she were to stay? What will the staff morale be like?

- Does Sue have any family issues that she needs to consider? e.g. ageing parents, children?

- Does Sue have hobbies, interests and volunteering pursuits that will enrich her life?

- If necessary, is the idea of working part-time more “do-able”? (Sometimes, we find clients can work for longer when they transition to retirement).

Assessing whether or not to accept a redundancy package or early retirement offer requires careful consideration and a clear understanding of both the “science” behind it (i.e. the numbers) and the “art”, or the mental, emotional, and physical effects of the package on a person.

Everyone has different circumstances, so whilst a redundancy package may work for one person, it may not be appropriate for another. It is important to consider all the facts and dimensions before making a decision.

Any advice included in this article is general and has been prepared without taking into account your objectives, financial situation or needs. As such, you should consider its appropriateness having regard to these factors and where appropriate obtain financial advice. Any tax information refers to current laws, is not based on your unique circumstances and should not be relied on as tax advice.