On 29 March 2022, Federal Treasurer, Mr Josh Frydenberg, handed down the 2022/ 23 Federal Budget. Responding to the increased cost of living, the Budget provides several measures to support businesses and individuals by temporarily reducing fuel prices, tax relief for low-to-middle income earners, incentives, and superannuation changes.

The full Budget papers are available at www.budget.gov.au and the Treasury ministers’ media releases are available at ministers.treasury.gov.au.

The taxation highlights are set out below.

Individuals

Low- and middle-income tax offset to be increased by $420

The low- and middle-income tax offset (LMITO) will include a cost of living tax offset in the 2021–22 income year. The cost of living tax offset is a flat $420 to be applied to all recipients of LMITO when they lodge their tax return.

The minimum LMITO for 2021–22 will be $675 for all individuals with a taxable income up to $37,000.

Individuals between $37,000 and $48,000 will receive $675 plus 7.5% of the amount of the income that exceeds $37,000.

Individuals between $48,000 and $90,000 will receive the increased maximum of $1,500.

Individuals over $90,000 in taxable income will have the maximum amount reduced by three cents for every dollar above $90,000, tapering off to an offset of $420 at $126,000 taxable income.

The LMITO is a non-refundable tax offset.

Source: Budget Paper No 2, p 16; Glossy “Australia’s plan for a stronger future — Overview”, p 26.

One-off payment to ease cost of living pressures

Individuals who are currently in receipt of an Australian government allowance or pension will receive a one-off payment of $250 in April 2022 to ease the cost of living pressures. Certain concession card holders will also get the payment.

The cost of living payment will be exempt from tax and will not count towards an individual’s income for social security income test purposes.

The payment will cover individuals in receipt of the age pension, disability support pension, parenting payment, carer payment, carer allowance, JobSeeker payment, youth allowance, Austudy and Abstudy living allowance, double orphan pension, special benefit, farm household allowance, and eligible Veterans’ Affairs payments.

The payment will also go to individuals who hold a Pensioner concession card, a Commonwealth seniors health card, or a Veteran Gold card.

However, if an individual receives multiple pensions or allowances, they will only receive the one-off payment once.

Source: Budget Paper No 2, p 167.

COVID-19 response package — Aged care

There will a further $458.1 million in funding over 5 years to support older Australians in aged care and aged care workers to manage the impact of COVID-19.

Part of the funding will be directed as follows:

- Approximately $215 million over two years from 2021-22 to provide bonuses of up to $800 to aged care workers in residential aged care and home care.

- Just under $125 million in 2022-23 to extend and expand funding for the Aged Care Preparedness program that supports aged care providers to manage and prevent outbreaks of COVID-19 and prepare providers to transition to living with COVID-19.

The funding will also be used to increase the capacity for vaccination services to residents and staff and extend PCR testing in residential facilities for a further three months to 30 September 2022.

Source: Budget Paper No 2, p 88-89.

Work-related COVID-19 tests tax deductible from 1 July 2021

Costs of taking a COVID-19 test to attend a place of work will be tax deductible for individuals and exempt from fringe benefits tax from 1 July 2021.

Legislation will be introduced to clarify that work-related COVID-19 test expenses incurred by individuals are tax deductible. Employers will not incur fringe benefits tax if they provide COVID-19 testing to their employees for work-related purposes.

The amendments will take effect from the beginning of the 2021–22 tax year.

Source: Budget Paper No 2, p 18; Assistant Treasurer’s press release “Tax deductibility of COVID-19 test expenses”, 8 February 2022.

Paid Parental Leave scheme enhancements

The Paid Parental Leave scheme will be overhauled by combining the current Parental Leave Payment (18 weeks paid leave for the primary carer) and the Dad and Partner leave payment (2 weeks paid leave) into a single combined Paid Parental Leave pay scheme of up to 20 weeks.

Leave will be fully flexible and both parents will be able to choose how they split the leave periods between themselves.

The Paid Parental Leave can be taken any time within 2 years of the birth or adoption of their child.

The income test will also be broadened to have an additional household income eligibility test.

Source: Budget Paper No 2, p 169.

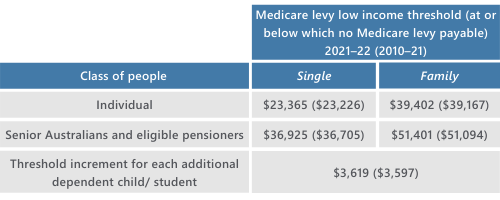

Medicare low-income thresholds for 2021–22

The CPI indexed Medicare levy low-income threshold amounts for singles, families, and seniors and pensioners for the 2021–22 year of income have been announced.

The new thresholds are:

Source: Budget Paper No 2, pp 24–25.

Increased support for affordable housing and home ownership

The number of guarantees under the Home Guarantee Scheme will be increased to 50,000 per year for three years from 2022–23 and then 35,000 a year thereafter to support home buyers to purchase a home with a lower deposit.

The guarantees will be allocated to provide:

- 35,000 guarantees per year ongoing for the First Home Guarantee (formerly the First Home Loan Deposit Scheme)

- 5,000 places per year to 30 June 2025 for the Family Home Guarantee

- 10,000 places per year to 30 June 2025 for a new Regional Home Guarantee that will support eligible citizens and permanent residents who have not owned a home for five years to purchase a new home in a regional location with a minimum 5% deposit.

Source: Budget Paper No 2, p 170.

Business

More COVID-19 business grants will be tax exempt

Payments from additional state and territory COVID-19 business support grant programs will be made non-assessable non-exempt income (NANE) for income tax purposes until 30 June 2022. The NANE treatment is to support businesses affected by state or territory lockdowns during the pandemic.

Since the 2021–22 MYEFO, the following programs have been made eligible:

- New South Wales Accommodation Support Grant

- New South Wales Commercial Landlord Hardship Grant

- New South Wales Performing Arts Relaunch Package

- New South Wales Festival Relaunch Package

- New South Wales 2022 Small Business Support Program

- Queensland 2021 COVID-19 Business Support Grant

- South Australia COVID-19 Tourism and Hospitality Support Grant

- South Australia COVID-19 Business Hardship Grant.

Source: Budget Paper No 2, p 17.

Increased deduction for small business external training expenditure

Small and medium businesses will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees.

The additional deduction will apply for businesses with aggregated turnover of less than $50 million. The external training course must be delivered by an Australian entity and provided to employees in Australia or online. In-house or on-the-job training and expenditure for persons other than employees will be excluded.

The measure will apply for eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (Budget night) until 30 June 2024. Where eligible expenditure is incurred before 1 July 2022, the additional deduction will be claimed in the tax return for the following income year.

Source: Budget Paper No 2, pp 26–27.

Increased deductions for digital adoption by small businesses

Small and medium businesses will be able to deduct an additional 20% of eligible expenditure supporting digital adoption.

The additional deduction will apply for businesses with aggregated turnover of less than $50 million. Eligible expenditure will include the cost of depreciating assets and business expenses supporting digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services. An annual cap of $100,000 will apply to expenditure eligible for the additional deduction.

The measure will apply for eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (Budget night) until 30 June 2023. Where eligible expenditure is incurred before 1 July 2022, the additional deduction will be claimed in the tax return for the following income year.

Source: Budget Paper No 2, p 27.

Apprenticeship wage subsidy extended

The Boosting Apprenticeship Commencements wage subsidy will be extended to support businesses and Group Training Organisations that take on new apprentices and trainees. The subsidy will now be available to 30 June 2022. This measure will provide for an additional 35,000 apprentices and trainees. Eligible businesses will be reimbursed up to 50% of an apprentice or trainee’s wages of up to $7,000 per quarter for 12 months.

Source: Budget Paper No 2, p 76; Glossy “Australia’s plan for a stronger future — Overview”, p 46.

Concessional tax treatment for carbon abatement and biodiversity stewardship income

Concessional tax treatment will apply from 1 July 2022 for primary producers selling Australian Carbon Credit Units (ACCUs) and biodiversity certificates.

Proceeds from the sale of ACCUs and biodiversity certificates generated from on-farm activities will be treated as primary production income, providing access to existing income tax averaging arrangements and the Farm Management Deposits scheme. The taxing point of ACCUs for primary producers that are eligible for tax averaging or the Farm Management Deposits scheme will also be changed to the year in which they are sold. Similar treatment will be extended to biodiversity certificates issued under the Agriculture Biodiversity Stewardship Market scheme.

Currently, proceeds from selling ACCUs are treated as non-primary production income and ACCU holders are taxed based on annual changes in the value of their ACCUs.

The measure will apply from 1 July 2022.

Source: Budget Paper No 2, p 26.

Expanded access to unlisted company employee share schemes

For employers that make larger offers in connection with employee share schemes in unlisted companies, participants can invest up to:

- $30,000 per participant per year, accruable for unexercised options for up to 5 years, plus 70% of dividends and cash bonuses, or

- any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

Regulatory requirements for offers to independent contractors will be removed, where they do not have to pay for interests.

Source: Budget Paper No 2, p 19.

PAYG income tax instalment system set for structural overhaul

The gross domestic product (GDP) uplift rate that applies to pay-as-you-go (PAYG) instalments and GST instalments will be set at 2% for the 2022–23 income year.

The GDP adjustment factor is usually calculated by using data from the Australian Bureau of Statistics and is based on GDP changes over the previous 2 calendar years. Using this statutory formula, it was expected that the GDP uplift for PAYG instalments would be much higher, causing potential cash flow issues for businesses. The 2% uplift rate will apply to instalments for the 2022–23 income year that fall due after amending legislation receives assent.

The current annual aggregated turnover thresholds for using the GST instalment method is $10 million and $50 million for PAYG instalments.

Source: Budget Paper No 2, p 29.

Continued reforms to insolvency arrangements

Additional funding will be provided to further reform insolvency arrangements. This includes:

- $22 million to implement reforms to unfair preference rules, including enhancing the Assetless Administration Fund, from 1 July 2023

- $7 million to clarify the treatment of trusts with corporate trustees under Australia’s insolvency laws, and

- $0.8 million in 2022–23 to implement the government’s response to the recommendations of the Review of the insolvent trading safe harbour, released in March 2022.

Source: Budget Paper No 2, p 171.

Business registry fees to be streamlined

Fees associated with Australia’s business registers will be streamlined over 3 years from 2023–24.

Company registration and lifecycle management are scheduled to move to a modernised platform in September 2023. These reforms to Australia’s business registers will:

- remove the companies annual late review fee

- reduce the number of fees paid for ad hoc lodgments under existing requirements

- remove fees for searches conducted on the new platform, and

- provide $300,000 to the Department of Treasury to redesign wholesale business register search services facilitated by third-party services.

Source: Budget Paper No 2, p 6.

Tax exemption for Australian sovereign wealth fund extended

Wholly owned Australian incorporated subsidiaries of the Future Fund Board of Guardians will be exempt from corporate income tax.

The current income tax exemption applying to the Future Fund Board does not extend to its wholly owned subsidiaries. As a result, these subsidiaries pay corporate income tax and subsequently refund it to the Future Fund Board through franking credits attached to the dividends paid.

The measure will have effect from the subsidiaries’ first income year after assent of the enabling legislation.

Source: Budget Paper No 2, p 20.

Tax administration

PAYG instalment systems to be modernised

Companies will be able to choose to have their PAYG instalments calculated based on current financial performance, extracted from business accounting software, with some tax adjustments.

The government will consult with affected stakeholders, tax practitioners and digital service providers to finalise the policy scope, design and specifications of this measure.

Subject to advice from software providers about their capacity to deliver, it is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024, for application to periods starting on or after that date.

Source: Budget Paper No 2, p 21.

Reporting of taxable payments reporting system data

Businesses will be allowed the option to report taxable payments reporting system data (via accounting software) on the same lodgment cycle as their activity statements.

Subject to advice from software providers about their capacity to deliver, it is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024, for application to periods starting on or after that date.

Consultation with affected stakeholders, tax practitioners and digital service providers will take place to finalise the policy scope, design and specifications of the measure.

Source: Budget Paper No 2, p 28.

Digitalising trust and beneficiary income reporting and processing

Trust and beneficiary income reporting and processing will be digitalised, by allowing all trust tax return filers the option to lodge income tax returns electronically, increasing pre-filling and automating ATO assurance processes.

The measure is proposed to commence from 1 July 2024, subject to advice from software providers about their capacity to deliver.

Source: Budget Paper No 2, pp 18–19.

Enhanced sharing of STP data

IT infrastructure will be developed to allow the ATO to share single touch payroll (STP) data with state and territory revenue offices on an ongoing basis.

The government will commit $6.6 million for this measure. Funding has already been provided for by the government. The funding will be deployed following further consideration of which states and territories are able and willing to invest in their own systems and administrative processes to pre-fill payroll tax returns with STP data, to reduce compliance costs for businesses.

Source: Budget Paper No 2, p 172.

ATO Tax Avoidance Taskforce to be extended

The ATO will be given funding to extend the operation of the Tax Avoidance Taskforce by 2 years to 30 June 2025.

The taskforce was established in 2016 to undertake compliance activities targeting multinationals, large public and private groups, trusts and high wealth individuals. The taskforce also scrutinises specialist tax advisors and intermediaries that promote tax avoidance schemes and strategies.

The ATO’s total resourcing requirement, including for the delivery of the extension of the Tax Avoidance Taskforce, will be settled as part of the independent review of the ATO’s ongoing resourcing requirement announced as part of the 2021–22 MYEFO measure titled Australian Taxation Office – continuation of compliance programs and independent resourcing review.

Source: Budget Paper No 2, p 29.

Deferral of 2019 Budget measure on Australian Business Numbers

The start date of the 2019–20 Budget measure requiring holders of Australian Business Numbers (ABNs) with an income tax return obligation to lodge their income tax return and to confirm their ABN status annually, will be deferred by 12 months to assist with integration into the Australian Business Registry Services (ABRS).

Source: Budget Paper No 2, p 18.

This article contains information regarding taxation and legislative change, which is based on policy announcements that are yet to be passed as legislation and may be subject to future change. Any advice included in this article is general and has been prepared without taking into account your objectives, financial situation or needs. As such, you should consider its appropriateness having regard to these factors before acting on it. Any tax information refers to current laws, is not based on your unique circumstances and should not be relied on as tax advice. Before you make any decision about whether to acquire a certain financial product, you should obtain and read the relevant product disclosure statement.