I’m a working mum; I have a 7-year old, a 4-year old and two 1-year olds. In my experience, working mothers have an ever-growing list of things to do and think about – and they usually all relate to their children. With this in mind, it is important to make sure we take time to think about ourselves too (mentally, emotionally, physically, and financially), both for the now and for the future. Your future self will thank you! In this article, I want to share some information on two government benefits that may help the financial side of things (since we all know that kids can be expensive!).

Parental Leave Pay

In Australia, the government recognises the need to support those of us creating, raising, and supporting the future generations. When you leave work to have a child, you may be entitled to Parental Leave Pay. This benefit provides a payment equivalent to the weekly rate of the national minimum wage for up to 18 weeks. It is paid by the government and is not related to nor impacted by any payment you may receive from your employer.

The key components of eligibility for Parental Leave Pay are;

- you must be the birth mother of a newborn child or the adoptive parent of a child,

- if you have a newborn, you must have registered or applied to register their birth, and

- you must be the primary carer of your newborn or adopted child.

You also need to;

- meet an income test (i.e. have individually earned less than $150,000 in the last financial year),

- meet a work test (i.e. have worked for 10 of the 13 months prior to birth or adoption at a minimum of 330 hours (around 1 day per week) in that 10-month period), and

- meet residency rules (i.e. you must be living in Australia at the time of birth or adoption and have citizenship, a permanent visa, or a special category visa).

The Parental Leave Pay benefit is designed to be claimed before you return to work, and you cannot work whilst you are receiving the payment. There is one exception to this, which allows for “keeping in touch” days providing you the opportunity to go to work on ad hoc occasions and get paid by your employer for those days.

You can take Parental Leave Pay before, during, or after any paid or unpaid employer-funded leave. This includes all of the following:

- maternity or parental leave;

- annual leave; and

- long service leave.

If you’re not eligible for Parental Leave Pay, you may still get both the:

- Newborn Upfront Payment; and

- Newborn Supplement.

These payments are not available to you if you or your partner have received Parental Leave Pay. Unless you are lucky enough to have twins! In which case you can claim Parental Leave Pay for one twin and still receive the Newborn Upfront Payment for the other twin. For brevity of this piece, I will not provide detail of these payments here.

In order to claim Parental Leave Pay, you will need to get set up with Centrelink via their myGov online portal. You will also need to talk to your employer as they will need to register with Centrelink in order to receive and pass on your payments. You can make your claim up to 3 months prior to when the baby/ child is due to come into your care, but no later than 1 year after that date.

At the time of writing, Parental Leave Pay is $150.78 per day (before tax). This amounts to $13,570.20 over the maximum 18 weeks (90 payable days) period. This will certainly help buy a pram, a car seat, and a good supply of nappies!

Childcare Subsidy

If you are planning to return to work after having your child but before they are school-aged, then you are likely to be paying for some form of childcare arrangement. Again, the government is here to help (within limitations, of course).

The Childcare Subsidy is the mechanism by which the government provides families with financial assistance to help with the cost of childcare. The payment is made direct to the childcare provider and may result in lower fees payable by you.

To be eligible for the Childcare Subsidy, you must meet the following criteria;

- You care for a child 13 years of age or younger for at least 2 nights per fortnight or have 14% care,

- You are liable for fees for care provided at an approved childcare service,

- You meet the residency rules (these are the same as noted above under Parental Leave Pay), and

- Your child is up to date with the government’s immunisation schedule.

It is relevant to note that approved childcare includes centre-based day care, family day care, outside school hours care (including vacation care), as well as in-home care. In-home care has additional eligibility criteria as it aims to assist those who work non-standard hours or are geographically isolated. If you are looking to use a nanny or some other form of in-home care, be sure to review the specific eligibility criteria for this type of care in order to confirm if you will be able to receive the Childcare Subsidy.

The subsidy you receive is percentage-based and depends on;

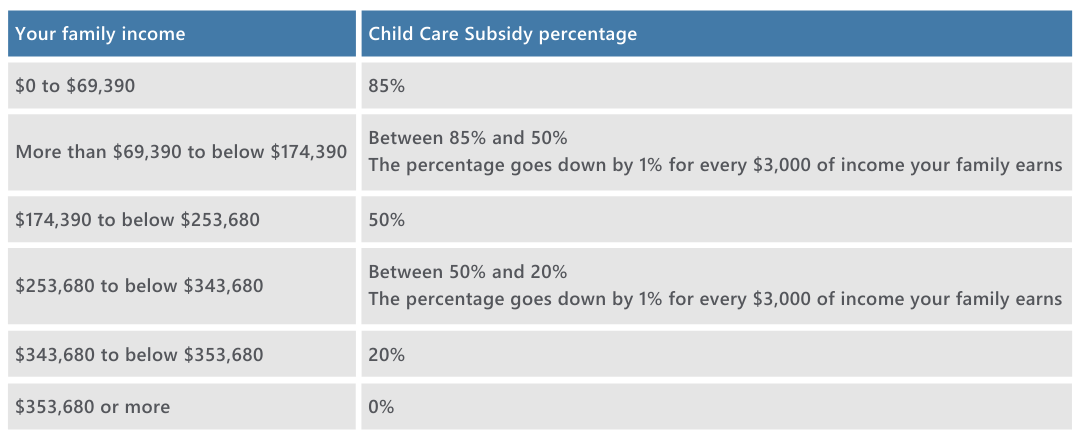

1. your family’s income,

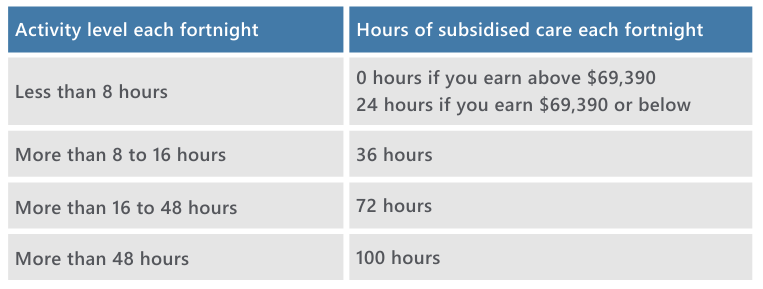

2. the hours of activity of both you and your partner, and

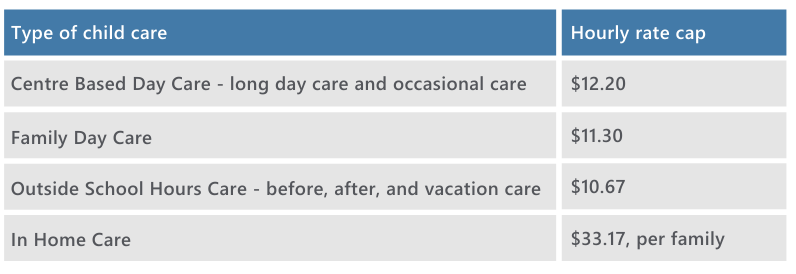

3. the hourly rate cap (determined by the government). It will apply to your hourly fee or the relevant hourly rate cap, whichever is lower.

I have provided further information on these three factors below.

Your family’s income

The subsidy paid by the government is capped at $10,560 per child (per financial year) for any families who earn between $189,390 and $353,680. If your family income is less, there is no annual cap.

When registering to claim the Childcare Subsidy, Centrelink will ask you to provide your family income estimate for the financial year. As this is an estimate only, Centrelink will withhold 5% of your subsidy until you have lodged your tax return at which time they will balance the actual and estimated figures and pay you any difference owing (or request payment if you substantially under-estimated your income).

Your hours of activity

Hours of activity relate to the hours you work per fortnight and affect how many hours of subsidised care you are eligible for. If you have a partner, Centrelink will use the lower of you and your partner’s activity levels – which is relevant if one of you is working part-time.

Hourly rate cap

Most childcare services charge an hourly fee. Some charge a daily session fee, which is divided by the number of hours in the session to get the equivalent hourly fee. If charged on a session basis, the childcare service will charge you for the day (session) regardless of the actual hours your child was in attendance.

The hourly fee you are charged is compared to the government’s hourly rate cap and the lower of the two is used when calculating the charges you have incurred relevant to the subsidy to be applied.

At the time of writing, the hourly rate caps are;

Let’s put all of the above together in a worked example.

Carlia and Graeme are both working. Their sons Luca and Callum are going to childcare on the 3 days a week that Carlia works. Carlia and Graeme are both Australian citizens and Luca and Callum have had their relevant immunisations.

Carlia works 3 days a week (22.5 hours) and earns $70,000 p.a.

Graham works 5 days a week (37.5 hours) and earns $120,000 p.a.

The childcare centre charges $12/ hour and Luca and Callum are there for 10 hours for 3 days/ week.

Based on family income of $190,000, Carlia and Graeme are eligible for a 50% subsidy on both Luca and Callum’s childcare fees. As the childcare’s hourly rate charged ($12.00/ hour) is less than the hourly rate cap ($12.20/ hour), the actual amount payable is applied.

Therefore, over the course of a year of childcare, Carlia and Graeme will get the benefit of $18,720 in childcare subsidy, as calculated below.

Childcare fees: $12/hr x 10 hours x 3 days x 2 kids = $720/week

Childcare subsidy: $720/week x 50% x 52 weeks = $18,720

Without the Childcare Subsidy, they would be out of pocket $37,440 p.a. ($720 x 52)

*This example has not taken into account the 5% withheld on the basis that their actual income matched their estimated income so once the end of year balance was completed, their net position was as if the 5% was not withheld.

With all government-related payments, it is recommended that you refer to servicesaustralia.gov.au for the most up to date information and assistance with application and claims.

If eligible, these two government benefits can save a family a substantial amount of money at a time when expenses are typically higher than usual. There is, of course, much more you can do to set yourself up for the future, both before you have children and whilst you are raising them. It is a well-known fact that many women in Australia suffer financially (compared to their male counterparts) due to the various life choices made around having and raising a family. Protecting the income you have as a working mum is an important consideration, so too is boosting your superannuation savings for the future, and this is something I will explore in my next article.

Disclaimer: Any advice included in this article is general and has been prepared without taking into account your objectives, financial situation or needs. As such, you should consider its appropriateness having regard to these factors before acting on it. Any tax information refers to current laws, is not based on your unique circumstances and should not be relied on as tax advice. Before you make any decision about whether to acquire a certain financial product, you should obtain and read the relevant product disclosure statement.