“Do we need to sell the family home?”

This is probably the number one question I get asked by concerned children when grappling with the idea of putting their parents into Aged Care. And whilst the answer will be “yes” for some, that is not always the case and there are plenty of options to work through first. Of course, in order to be able to understand the options, you need to be able to understand exactly what costs you are faced with …

What is Aged Care?

As the population continues to age and medical breakthroughs become more prevalent, an increasing number of Australians are seeking Aged Care services. According to the Australian Government’s Department of Health, Aged Care is defined as “the support provided to older people in their own home or in an aged care (nursing) home. It can include help with everyday living, health care, accommodation and equipment such as walking frames and ramps.”

Specifically, Aged Care services include:

- Care in one’s own home;

- Residential care in aged care (nursing) homes; and

- Short-term care (such as after-hospital and respite care).

This article will only consider factors relating to the most costly service; Residential Aged Care.

What are the costs?

The cost of Aged Care varies, however, if eligibility criteria are met, the Australian Government will subsidise the cost of a person’s care.

Which raises the question; what are the costs? Aged Care costs can be divided into two categories:

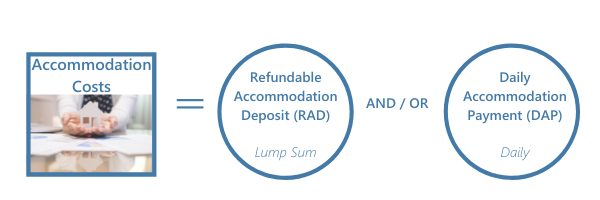

Accommodation costs

The Accommodation cost is the rate published by the facility and is either paid as a lump sum (Refundable Accommodation Deposit – RAD) or a daily fee (Daily Accommodation Payment – DAP). The RAD is usually in the region of $500,000 and is set by the provider based on the type and size of the room and the facility’s location. Although this is the advertised cost, it does not need to be paid upfront or in full in order to access care. Paying all or a portion of the accommodation cost by way of a daily fee means you don’t necessarily need to sell the house or incur any debt to pay for Aged Care for yourself or a loved one. Based on current relevant interest rates, paying a $500,000 accommodation cost via a daily fee arrangement would equate to $96.71 per day.

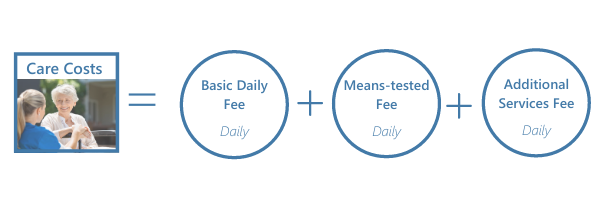

Care costs

The Care cost includes three main fees:

1. a basic daily fee;

2. a means-tested fee; and

3. an additional service fee.

The basic daily fee is a flat-fee payable by everyone and is indexed every six-months. This fee equates to 85% of the single person pension rate. The means-tested fee is based on the aged care resident’s income and assets, and is calculated as a daily rate. This ensures that those who can afford it are paying the costs, whilst those who are unable to afford it are being subsidised by the government. Additional service fees are specific to a facility and can be included in a room/ care arrangement. Such a fee pays for certain lifestyle choices of the patient.

Planning for the costs of residential aged care

With these key understandings in mind, the following list outlines important factors to consider when calculating the cost of Aged Care for yourself or a loved one.

1. Don’t forget to include a cash flow allowance for personal incidentals (general rule-of-thumb is to allow for $100 per week for general necessities such as toiletries).

2. Some facilities charge a compulsory additional services fee as standard, i.e. you can’t opt out of the additional services. These costs relate to lifestyle-based luxuries and do not affect the level of “care” received.

3. The costs of moving into an Aged Care facility are two-fold; Accommodation costs (RAD or DAP), and Care costs. The Care cost means that if the person moving in is a member of a couple, the couple’s daily living expenses will include the home expenses as well as the care costs, potentially doubling the pressure on their regular cash flow.

4. You can accept and sign a residential agreement before deciding how much of the Accommodation cost (RAD) you wish to pay upfront. You have up to 28 days to make the decision and six-months to pay the agreed amount.

5. Care must be taken when the Accommodation payment is paid by someone other than the person moving into care, as this payment is refundable to the care recipient upon their death.

6. For Aged Care residents who have a spouse (outside of care) the means-tested fee is calculated based on 50% of the combined total of the couple’s assets regardless of the ownership of each asset.

7. The value of the home is assessed at a capped rate in order to calculate the means-tested fee. This is different to Centrelink’s assessment for the Age Pension.

8. Once any amount of RAD is paid, there is the option to draw down from that deposit to assist in meeting any residual DAP payments required. This helps to alleviate ongoing cash flow requirements, but results in the depletion of the RAD over time.

In all cases, it is important to read the residential facility’s fee agreement before signing.

Do you have a question or need assistance?

If you are exploring Aged Care services for yourself or a loved one and need assistance in understanding the costs involved, please get in touch.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice. The Centrelink-related figures were correct at time of writing but are subject to change.