A significant underinsurance gap exists both between the sexes and within various demographic segments of the Australian community. Generally, men are almost twice as likely to have life insurance and more than three times as likely to have income protection compared to females.1 There are many reasons women remain underinsured. Time out of the workforce is a primary concern for many women and not just because of children; statistics show females are more likely to adopt the role of caregiver if something happens to a child or a relative. These unique issues, as well as the nature of women’s health, make insurance planning conversations vital. This article explores the relatively common yet poorly understood condition, endometriosis, and uses this as an example of a health matter that can have significant underwriting implications for women which can then impact insurance outcomes. We also discuss key things women should be mindful of before seeking financial advice on personal risk insurance cover.

What is Endometriosis?

Endometriosis is a common disease in which the tissue that is similar to the lining of the womb grows in other parts of the body. According to Endometriosis Australia, “more than 830,000 (more than 10%) of Australian women suffer from endometriosis at some point in their life with the disease often starting in teenagers. Symptoms are variable and this may contribute to the 7- to 12-year delay in diagnosis. Common symptoms include pelvic pain that puts life on hold around or during a woman’s period. It can damage fertility. Whilst endometriosis most often affects the reproductive organs, it is frequently found in the bowel and bladder and has been found in muscle, joints, the lungs and the brain. In an Australian government report, endometriosis is reported to cost Australian society $9.7 billion annually with two-thirds of these costs attributed to a loss in productivity with the remainder, approximately $2.5 billion, being direct healthcare costs”.2 The condition clearly has profound implications at many levels from both a patient and insurer perspective in relation to life, total and permanent disability (TPD), income protection and trauma insurance, including:

Medical disclosure/ history: at underwriting and contract inception stage, given the varying symptomology that women experience at different times and the frequent delays seen in diagnosis.

Pricing: does the health, age of the insured, tobacco smoking status, lifestyle (including height, weight, pursuits, pastimes), co-morbidities, occupation, the diagnosed existence of the condition itself and its severity raise any additional risk of a claim occurring under the particular type of policy (such that it would warrant an additional premium cost so the insured is appropriately contributing to the higher risk of a future claim relative to a ‘standard life’)? Trauma insurance will be priced differently to TPD and life covers, for example.

Contract terms and conditions: which life insurers pay out for endometriosis (if any), at what level of severity and under what type of policy (and are they partial or full payouts)? If one already has a formal diagnosis, will an insurer exclude the condition for new cover? If so, what type of policy would typically apply an exclusion, accept someone on normal or loaded pricing and how are those policies worded?

Treatment: does the way the condition presents itself in a given patient (insured) and the medical treatment (medication or surgical) and/ or allied treatments (physio, psych or alternate) that the patient undertakes, increase or lower the risk and incidence of endometriosis symptomology? What is the quality of life and what level of co-morbidities are occurring (i.e. that could give rise to a future or current claim)? Different perspectives arise in the eyes of both the insured and the insurer from an insurance medicine point of view (which must be contrasted with clinical medicine):

- That is, there can be material differences with how various Chief Medical Officers (CMOs) inside life insurance and reinsurance organisations view and assess endometriosis risks based on their claims experience associated with the condition compared to how a patient’s Treating Doctor may approach clinical treatment. These views impact the actuarial and underwriting guideline assumptions used in assessments and may differ from the opinion of the treating doctor practising clinical medicine. For example, in insurance medicine there are significant differences between possible beneficial effect and side-effect profiles of someone treating the condition with yoga versus medicinal cannabis versus opiates versus laparoscopy. Insurers and reinsurers look at the pricing of risks based on exposures and claims experience in various jurisdictions in which they do business: noting 176 million women worldwide suffer from endometriosis.

We explore some of the implications and considerations regarding endometriosis in a personal insurance setting below to illustrate the nuances that can exist when it comes to personal risk cover for women and why a better understanding of these may help narrow the underinsurance gap.

What disclosure, price, contract term, and other matters should women understand?

Life risk insurance cover(s) can be sourced ‘direct’, via a superannuation fund, or (ideally) via a financial adviser that specialises in the area (particularly if there are nuances in medical or family history or events) or occupation requirements (e.g. medical professionals may require specific “needlestick cover” under income protection). A caveat emptor in terms of ‘know your source’: so-called ‘direct’ policies (purchased via the phone or internet with an insurer) should be treated with the utmost caution as some of these policies have been known to have complex pre-existing condition exclusions, high pricing and poor claims outcomes (sometimes due to ‘at claim-time underwriting’). Retail advised contracts purchased via a qualified adviser where appropriate underwriting and pre-assessments are undertaken under a ‘best interests’ advice framework at commencement of the contract will nearly always tend to serve women better by providing greater premium stability, improved claims outcomes and more flexibility in contract terms around important matters such as parenting or career break clauses (premium/ coverage pause, for example) or women-focused organ coverage.

Application and Inception stage

Medical disclosure/ history: it is important that a full and frank personal statement (disclosure) is made based on what is asked of you or what reasonably should be made known in order for an insurer to ascertain whether to provide you cover. This will include first degree level family history and may include disclosures of your child’s history if you are seeking cover for them as well. Not everyone requires medicals or blood tests and the use of technology solutions around placement with advisers/ insurers is improving.

Pricing: in addition to the factors discussed above, modelling the merit of stepped premiums (which start cheaper but increase with age as the risk of a claim event increases) versus level premiums (where the age-based rate is set at inception) can be worthwhile depending on how long you are likely to require cover(s). A very important discussion regarding death, TPD and income protection ownership is required (as to how much one holds inside versus outside superannuation) as this can have critical cash flow, tax and retirement implications (e.g. premiums can erode superannuation balances if one is not contributing while out of the workforce but premiums are still being deducted). Income protection is tax deductible so women on higher marginal tax rates may prefer the tax deduction in their name (rather than in the hands of the superannuation fund trustee).

Contract terms and conditions: it is important to understand the insurance contract terms and conditions that govern your coverage. This not only involves understanding the Product Disclosure Statement (PDS) but also governance documents such as Trust Deeds, Policy Documents, and Beneficiary Nominations that may apply and that can be structured differently depending on the goals and needs of the insured or policy owner or entity involved.

Claims

Some traditional Trauma insurance policies pay out partial/ advancement benefits upon diagnosis with ‘Advanced Endometriosis’ which one prominent insurer defines by way of example as, “the presence of endometrial tissue (normal lining of the uterus) outside the uterus, usually in the pelvic cavity. Advanced Endometriosis is a partial or complete obliteration of the cul-de-sac (Pouch of Douglas) by endometriotic adhesions, and/ or the presence of endometriomas (cysts containing endometriotic material), and/ or the presence of deep endometrial deposits involving the pelvic side wall, cul-de-sac and broad ligaments, or involving the wall of the bladder, ureter and bowel for which surgical treatment is required.”

In the event an insured suffers temporary or permanent incapacity or disability (the inability to work or conduct the duties of one’s occupation, or perhaps any occupation, due to sickness or injury, including from endometriosis), then provided it is not a specifically excluded condition, these policies may respond subject to any applicable wait and benefit period terms.

Hypothetical Case Study

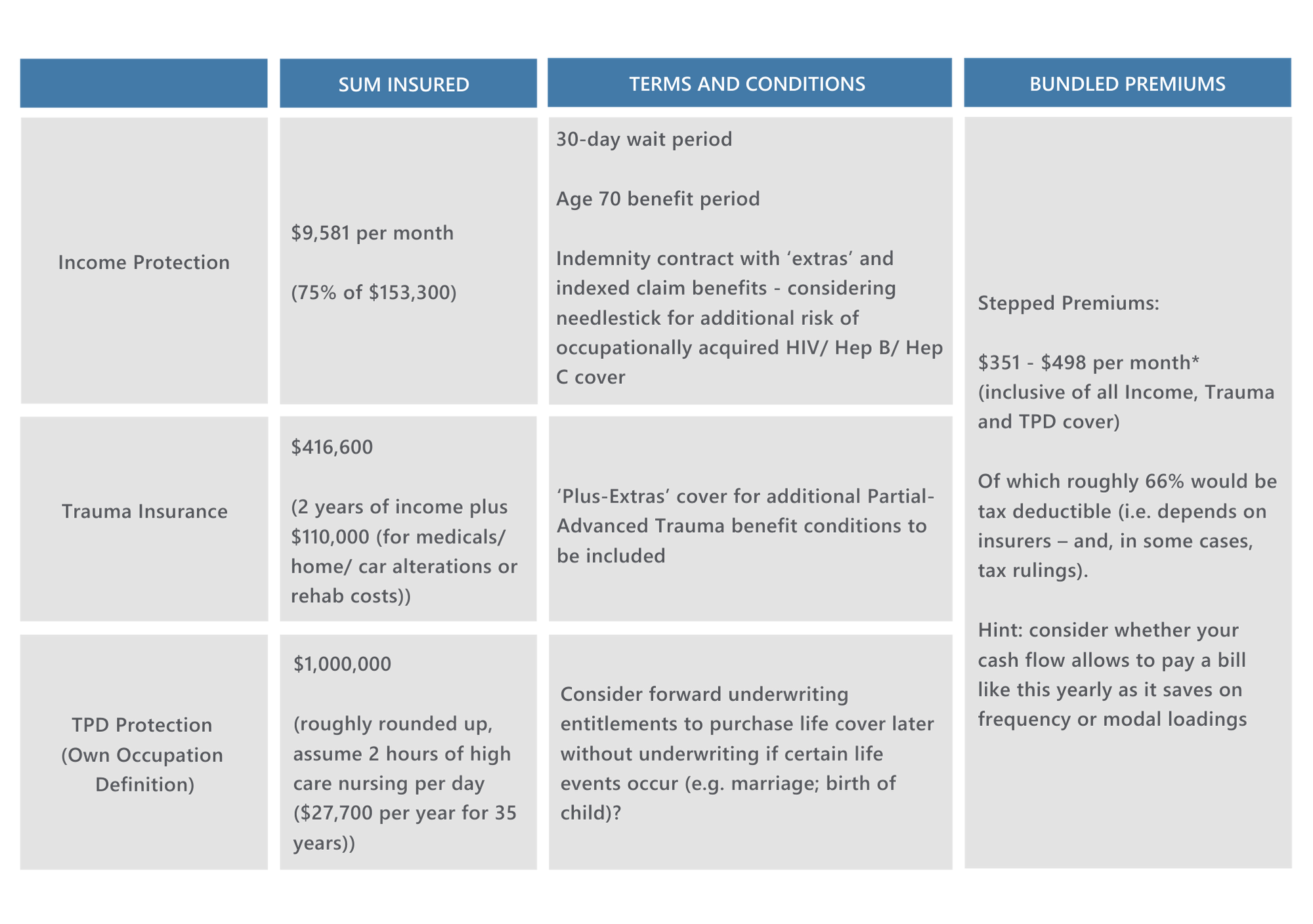

Anna is a single 30-year-old, non-smoking doctor based in a QLD private practice earning $140,000 p.a. plus superannuation. She is seeking appropriate cover for her financial circumstances. Her BMI is 26 and she is in good health. She has no debt and no dependants, and requires:

*This pricing above assumes no loadings or exclusions: a so-called “standard life insured”. In one scenario considered, a woman of this profile with endometriosis, however, whose:

- condition was not associated with a malignant tumour of any form;

- was not awaiting the results of any tests, investigations, or referrals to a specialist;

- whom had a history of surgery with full recovery and last having consulted a specialist in 2019 for the condition (but with a total of 14 days off work from the condition in the past 12 months) was assessed as:

-

- Standard pricing rates (no loadings or exclusions for Trauma);

- Exclusion for endometriosis-related treatments/ complications under TPD and Income Protection

-

Interestingly though, a one-off operation with full recovery 12 months ago and no time off work (other than for the surgery) may result in no exclusion and standard pricing for all covers… so underwriting assessments are severity/ frequency dependent and likely subject to medical reports. This is common with other health conditions for women.

An adviser in this instance would need to consider the role of existing cover (including perhaps auto-acceptance basic default cover via superannuation or other group employer arrangements) and assumptions as to their retention or replacement as part of a broader advice strategy proposition based on what is in the best interests of the insured. Those matters are beyond the scope of this paper (as are comments related to ‘Approved Product Lists’ of life insurers noting that it is always prudent to ask how many insurers your adviser may be able to recommend or choose from).

What’s the best approach when it comes to female specific life risk insurance strategies?

As with “endo” where there is no ‘best treatment’ or ‘best approach’ (since treatments will work differently for individual women with endometriosis), it is the same when it comes to insurance solutions for women. Nuanced personalised, advised solutions are likely to be required.

Women should be aware of the different kinds of treatments and condition severity levels driving different possible outcomes under various types of insurance policy scenarios. The side effects or complications of a condition and therefore potentially a variety of underwriting/ policy term/ claim outcomes may eventuate. The underwriting assessment of certain treatments will also raise novel questions into the future. On this point, given the emerging propensity for Australian women to self-manage endometriosis using medicinal cannabis and its reported high rate of efficacy to treat chronic pelvic pain3, it remains to be seen if life insurers, their underwriters and reinsurers will adopt a more progressive stance toward the use of this treatment option in women. Whilst the historical basis and logic for its use in a variety of gynecological presentations stretches back millennia (including in Western medicine between 1840-1940)4, its status as “planta non-grata” legally for the past 80 years has meant that it remains to be seen if it will be conclusively re-accepted/ deemed an effective, low cost, treatment program option for endometriosis and chronic pelvic pain in modern Australian clinical medicine (and therefore accepted as not entailing more ‘risk’ in an Australian insurance medicine context). Again, when the use arises, bespoke explanations/ triage of women using this medication through the insurance underwriting or even claim process with their life insurer requires empathy, lateral thinking, pragmatism, passion and persistence to get good outcomes for all parties involved.

If you would like any assistance in relation to your personal insurance strategy, please get in touch.

About the Author

Andrew Proudfoot is the Director of Risk and Succession at MGD, a boutique professional services practice based in Brisbane and Sydney that specialises in private wealth, tax, self-managed superannuation fund advisory, life risk advice and succession planning. With 19 years financial services experience, Andrew has successfully settled more than $14m in life, trauma and disability insurance claims for clients over the past four years alone (with nil declined and no clients requiring the services of a lawyer to manage their claims). Andrew holds Bachelor degrees in law and economics from the University of Queensland along with a Master’s degree in Taxation and Financial Planning from UNSW. In 2020, Andrew commenced higher degree research with the NICM Health Research Institute at the Western Sydney University where he is working with senior researchers with expertise in Gynecology, Obstetrics, Endometriosis and Pharmacognosy from across Australia, New Zealand and Canada to optimise treatments for the symptomatic management of endometriosis: https://www.nicm.edu.au/research/research_projects

Endometriosis Australia Ltd endeavours to increase recognition of endometriosis, provide endometriosis education programs and help fund endometriosis research. If you wish to support future, valuable research you can donate to Endometriosis Australia Ltd via their website: https://www.endometriosisaustralia.org/

Disclaimer: This article contains general advice only and does not take into account your objectives, financial situation or needs. You should consider its appropriateness having regard to these factors and where appropriate obtain financial advice. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant Product Disclosure Statement. The information contained within these calculations is meant as a guide only, sourced from IRESS Risk Researcher 28.8.2020 and should in no way be construed as providing qualified medical nor financial advice. All data is based on Australian information; trends for other countries may differ. Statistics are only available for the stated age ranges.

1 See generally Asteron Life (2008) and NMG Consulting (2020). Australian Life Insurance Market Research Report. Retrieved from https://static1.squarespace.com/static/5def33c85605ee78480a0134/t/5f163d6c2c989e153c655081/1595293055411/NMG+-+Australian+Life+Insurance+Research+Report.pdf

2 Endometriosis Australia. (2020). What is Endometriosis? Retrieved from https://www.endometriosisaustralia.org/

3 “Self-management strategies amongst Australian women with endometriosis: a national online survey” (2019): https://link.springer.com/article/10.1186/s12906-019-2431-x

4 Stimulation of GPR18 increases cellular migration (McHigh 2010). Cannabidiol (CBD) is a GPR18 antagonist that should inhibit endometrial metastasis (Russo 2011). Endometrial biopsies reveal TRPV1 reactivity in women with endometriosis with chronic pelvic pain (Rocha 2011). CBD stimulates and desensitises TRPV1 and should decrease neuropathic pain, while CB1 and CB2 receptor activity were reduced in endometriosis lesions over controls (p=0.001). Anti-proliferative effects and pro-apoptotic effects have been noted CB1 and CB2 agonists. Delta9THC, CBD and caryopyllene preparations have been suggested in the past for endometriosis presentations (Russo, 2018): https://www.youtube.com/watch?v=HsVZsx3xEsg