This article is the first instalment of a series we have developed on investment fundamentals which we will continue to build out over the coming weeks and months.

The issues may be big or small, but ones we consider relevant for everyone, young or old, wealthy or aspiring to be so.

If ever you’d like more information, please don’t hesitate to contact us.

Investment Fundamentals 101

1. Maintain a cash reserve / emergency fund – We all need readily available monies to access in case of an emergency or contingency, for example, if you or a family member need urgent medical treatment. These monies may sit in an at-call account or in a mortgage offset account. There is no exact magical amount – you might be comfortable with an amount of $25,000; others might require $100,000.

2. Save so you can invest and get a budget figured out. This is the most fundamental step of all and there are various tools out there to help. You can’t get ahead financially if you’re spending more than you’re earning.

3. Reduce tax ineffective (non-tax-deductible) debt asap. Tax ineffective debt includes credit card debt, personal loans and home mortgages. Credit card debt and personal loans are generally used to fund lifestyle expenses or assets (like cars) and generally attract a higher interest rate. It’s pointless earning 6% on an investment if the bank is taking 14% on your credit card. For someone earning $80,000 p.a. who has a credit card debt attracting interest of 14% p.a., an alternative investment needs to generate a risk-free rate of return of more than 21% p.a. to make it more worthwhile than paying off the debt. Your home is one of the very few capital gains tax-free assets. Paying down your home mortgage increases your net equity position in your property and provides a solid base if it’s needed as collateral to purchase other investments.

4. Determine the best tax structure (“housing”) for your investments. Who will own / have title to the investments? This decision needs to be made long before actual investment decisions are made because it’s necessary to figure out the tax implications of holding an investment. i.e. should the investment be held in personal names or in the name of a superannuation or pension fund or an investment bond or a company or family trust (with multiple beneficiaries)? Each of these structures has a different tax rate. For example, superannuation fund earnings are taxed at the maximum rate of 15% but there are strict rules about the sort of investments that can be held in a superannuation fund. Personal marginal tax rates can be as high as 47% for those who earn more than $180,000 p.a. A couple with different individual tax rates might initially think it sensible to hold an investment in the name of the lower-earning spouse. However, if a significant capital gain is ultimately expected, then it might be better to have the asset held in joint names so that the capital gain can be shared. It’s important to consider these issues from the outset because whilst ownership changes are possible, they usually trigger a capital gains tax event, and possible costly stamp duty implications.

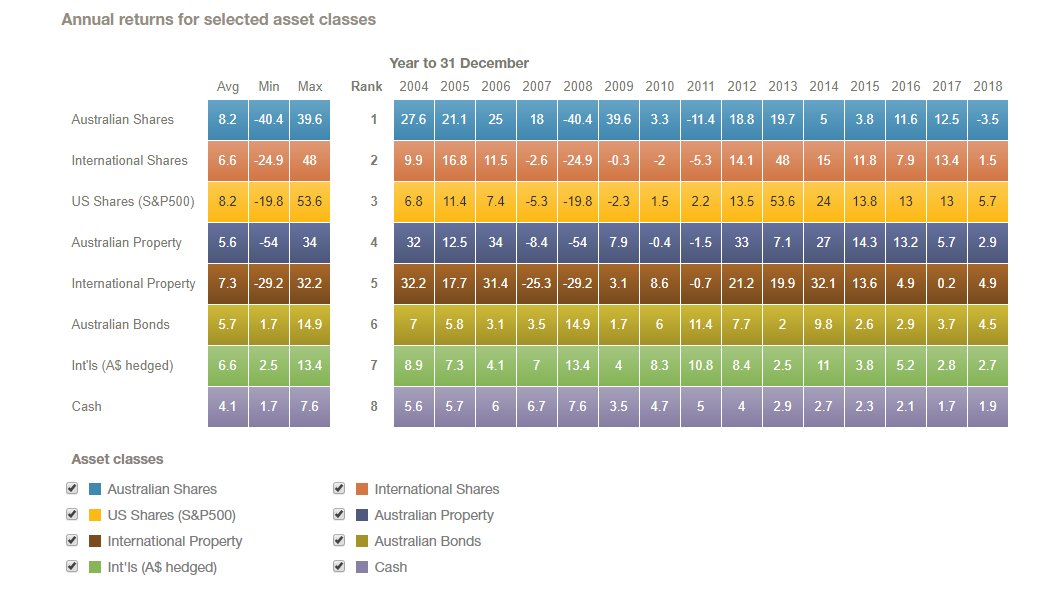

5. Understand the different asset classes and adopt a goals-based investing approach. Different investments work better over different time frames. The chart below from Vanguard shows the returns from the various assets from 01.01.2004 to 31.12.2018. Clearly, cash has the lowest range of returns and it suffers the least from market volatility. Shares and property, on the other hand, have historically achieved the highest returns on average over long periods of time, offering both income (e.g. dividends and rent) and capital growth (e.g. share / property prices rises), but carrying a greater capacity for negative returns over the short-term.

The key to successful investing is to match investments with your time-based financial objectives. The general process is to:

1. work through your expected cash flows (positive and negative) including outflows like general living costs, capital expenditure / home renovation plans, holidays and car upgrades;

2. estimate the level of funds required over the next couple of years (those funds should be kept in cash);

3. determine what’s required over years 3 to 5 (those funds could possibly be invested in a conservative fund);

4. estimate funds required after year 5 (those funds could possibly be invested in diversified funds).

This portfolio construction methodology minimises the risk of not meeting your investment objectives. It ensures that you’re not a forced seller of longer-term investment units at potentially reduced prices to fund immediate expenses. When funds aren’t required in the short term, an investor has the ability to “ride” out the market volatility and return fluctuations.

There is no hidden truth to becoming a successful investor. It takes experience, research, knowledge, common-sense and, most importantly, patience. These fundamentals are only the first steps in the investment journey – but they are critical. If you’d like to discuss any of the above in more detail, or would perhaps appreciate a second opinion on your investment strategy, please get in touch.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice.